The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

No enthusiasm.

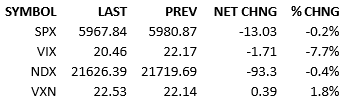

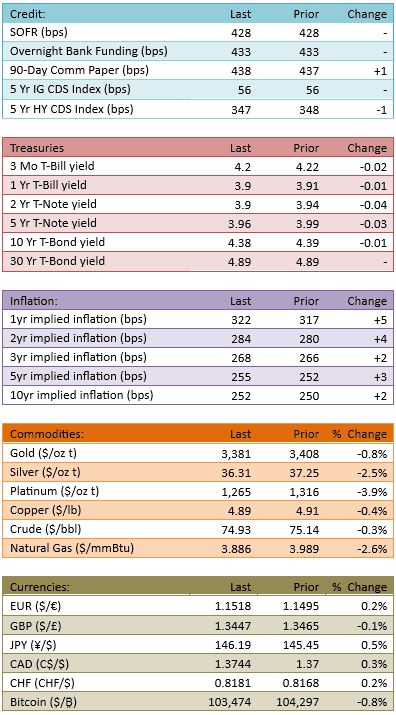

While the market opened positively, it rolled over quickly and the S&P was flat-to-down from the morning on. News wasn’t material as the market remains partially paralyzed by the 2-week time horizon for negotiations before President Trump ultimately decides whether to bring US force to bear. As such, stock market investors aren’t running for the exits but they have no enthusiasm to lift offers and continue the rally either. Treasury yields dropped small today, perhaps signaling increasing appetite for safety. Capital flow (140%) was relatively light during the session but increased into the close. Today was monthly option expiration plus futures settlement, which probably explains the pattern.

The drop in the index was quite small today and the bears barely won the week as well. Despite the geopolitical headlines, the market is not very upset. This also explains the lack of upside continuation from the April bounce. Investors may want to follow the chart higher. They probably also agree that the market should go higher. They just cannot, or will not, drive it higher with the precarious state of things in the middle east. It feels very much like investors are going to wait for a meaningful headline before acting in size.

That means no volatility for a while and then some huge reaction to a headline. It could be either bearish or bullish. There’s no implication for direction at the moment.

Have a great weekend, see you Monday.

-Mike

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.