The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

Old habits

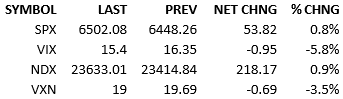

US equity investors went to work pushing prices higher. The open was tepid, +8 points. The tape jiggled around about an hour, briefly falling to flat, then recovering. From 10:30 AM on, the bulls controlled the market and the S&P has recovered most of the losses from Friday and Tuesday. Treasury yields fell some across the curve and Fed Funds futures price a 25-bip cut on Sep 17th with 97% probability. Total Fed cuts for the year price at 60 bips.

This morning’s economic data contained a lot of different datapoints but the market didn’t react significantly to them. ADP (+54k vs +68k est & +106k prior revised from +104k) was a bit weak. Weekly jobless (237k vs 230k est & 229k prior) was a bit weak also. PMI data was a bit weak too. ISM services were a bit stronger. Prices paid were a bit lower.

It was a slightly mixed bag of results. The main conclusion to this data is that the big picture narrative is unchanged. We’re waiting on nonfarm payrolls data (+75k est vs +73k prior) to really influence us though.

Today was pretty unremarkable if you step back some. The headlines were inconsequential and the local bottom appears to have printed on Tuesday at noon. Yesterday was a bit of a confirmation and today became continuation. I think the equity investors, who were willing to act ahead of nonfarm payrolls, just stuck with the standard playbook. Easy as A B C.

I think it was just that simple for most of today’s buyers.

Whether they are smart or foolish will be determined by tomorrow’s action.

I suspect they’ll be vindicated but ya’ never know.

See you tomorrow.

-Mike

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.