The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

Tepid.

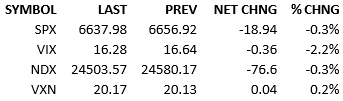

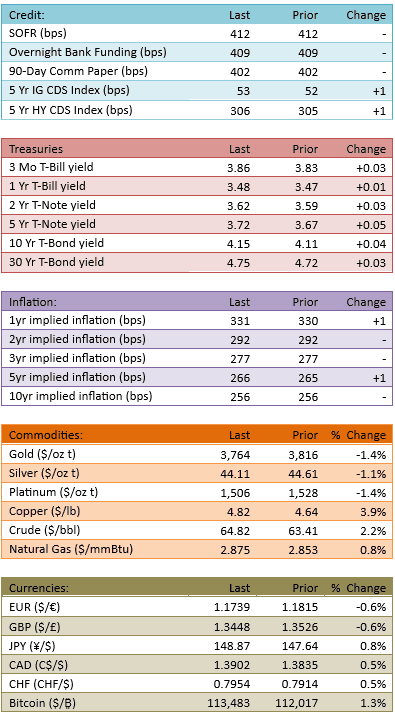

Dip-buyers were at work in the premarket when S&P futures were about +10. The index opened about +15 and dropped immediately, trading flat for 90 minutes and then sinking further for the rest of the day. Yields climbed a bit and headlines were tame.

If yesterday was reflexive dip, today was a no-show by the dip-buyers. The investing landscape is unaltered over the last two sessions and yet the bulls don’t have the appetite or the muscle to push prices up. I do not believe that they have disappeared. It is a matter of when, not if, they show up.

So when will they act? Are they playing a technical game? How patient are they willing to be? We’re 1% off the highs, which wasn’t enough to get them motivated. 6500 is an interesting technical level, 3% off the high. That seems an attractive entry point. In between here and there is technical no-man’s-land.

Sure we could bounce off of any 50 point level or any quarter percent decline but there’s no compelling level that sticks out on the chart. Considering that the market has been playing a chart-game of some kind for the last few months, if we can’t find an obvious implication from the chart, we’re left shrugging our shoulders.

Without a fresh news catalyst, we’re left balancing the long-term bullish trend with the short-term overbought conditions. The overbought conditions essentially worked themselves off today.

So is that enough to excite the bulls or do we need the pendulum to swing into oversold territory?

I’m not sure. I thought the bulls were itching to pounce on any, and all, dips. That’s not the case.

See you tomorrow.

-Mike

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.