The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

Rolling waves.

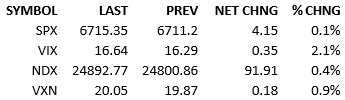

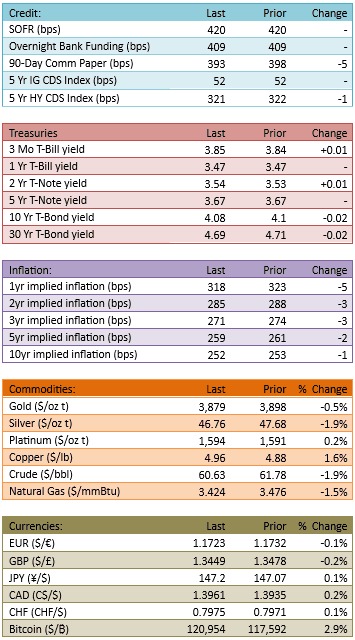

Government shutdown headlines continue to dominate and markets haven’t been terribly concerned, yet. Overseas markets rallied some and our morning futures rallied sympathetically. The S&P 500 opened at new all-time highs, about +20 points and then fell down quickly, trading to flat around 10:30 AM and then down about 15 points before lunch. The tape recovered slowly in the afternoon and gently faded into the close. The Treasury curve flattened a bit, something less common of late, and that may have assisted the equity longs today. Capital flow was healthy at 113%.

News was yawn-worthy and equities have few external catalysts to contend with. The price action is solely a function of psychology and crowd behavior. For some reason, bears have applied pressure early in the day and they have been turned around by the afternoon. Intraday patterns are fickle and don’t usually last long but it’s notable not just because it exists so obviously but also because it’s occurring in the absence of news/data. This is a pure intrinsic investor behavior.

Are Europe’s final hours of trading to blame? Are US retail flows building in the afternoon? Even if these are the root causes of these minute-by-minute patterns, I don’t think we can count on them for much longer.

That said, maybe time buys for mid-morning and save sales for the close?

If we look ahead a bit, the next big events for the market will be the earnings season and whenever the US government re-opens.

Earnings season essentially starts October 13th.

The best guess for a US government re-opening is in about 10 days.

Until then, we’re probably just continuing with the September momentum and present sentiment.

It’ll be boring but bullish.

See you tomorrow.

-Mike

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.