The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

Feeling fine

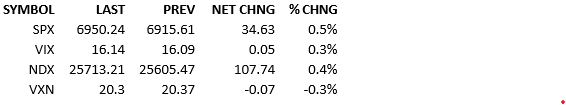

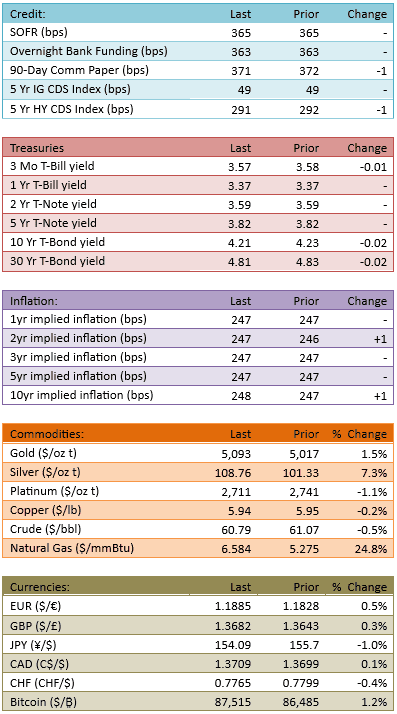

Rumors of a Yen intervention began Friday and continued over the weekend. The Yen strengthened 2.8% over the two sessions, a huge amount. Additionally the Nikkei fell 1.8% overnight and the Japanese bond market, which has been selling off for more than a year, is threatening an ugly unraveling. The larger point being that Japan is potentially a bearish catalyst in-the-making. So far, US markets are unfazed. S&P 500 futures were down substantially last night but recovered to flat by 4 AM. The index opened about +10 and added 20 more points early, adding another 10 in the afternoon. The rally was steady and broad and US investors are talking about earnings season, not Japan. The Treasury curve came in small today and US capital flow was 102%.

Japan is the issue that isn’t concerning, yet. It is not clear but *perhaps* the rally in US treasuries and US stocks represents a flight towards US capital markets away from Japan. If Japan remains worrying, perhaps US markets benefit. However, if Japanese markets actually collapse, the US reaction will not be bullish, we will succumb to a huge risk-off impulse. The rest of the world will do the same.

Unfortunately, the Japanese risk to our market won’t be felt until it’s too late. Investors are acting as though whatever problems Japanese markets are facing, they are solely Japan’s problems and they won’t spill over. That’s certainly true if the problems remain small. If there is a serious market dislocation over there, likely in their bond market, the contagion probability is 100%. Japan is too big and too interconnected.

Hopefully I am just being a nervous Nellie but their 40-year bond yield exceeded 4% last week, a record. Their entire yield curve is 40 to 155 bips higher than a year ago. Their currency has weakened steadily since April, almost 12% until the Yen intervention rumors started. When a country’s yields keep climbing and their currency keeps weakening and their central bank intervenes in their currency, that’s a bad fact pattern. If you are a student of emerging markets, that’s the pattern before a capital markets crisis. The question is, will capital flee Japan as though it were an emerging market or can the Bank of Japan and the Fed and maybe the European Central Bank hold back the market and then reverse investor perceptions?

I hope we don’t have to find out. Until something in Japan actually spills over, our stocks are hunky-dory and looking forward to new highs, just 36 S&P points away.

See you tomorrow.

-Mike

Visdom Market Commentary

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.