The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

Ordinary

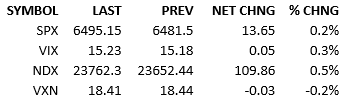

Overseas markets rallied a bit and our did the same. Headlines were pedestrian and bulls pushed the S&P 500 up a little today. Tech led the way and the Treasury yield curve flattened. Capital flow was 106%, a healthy level that maybe suggests summer doldrums are behind us and investors are back-to-business.

On the calendar, tomorrow looks quiet. I would expect another day like today.

Maybe the next inflation tidbits will stir up market action.

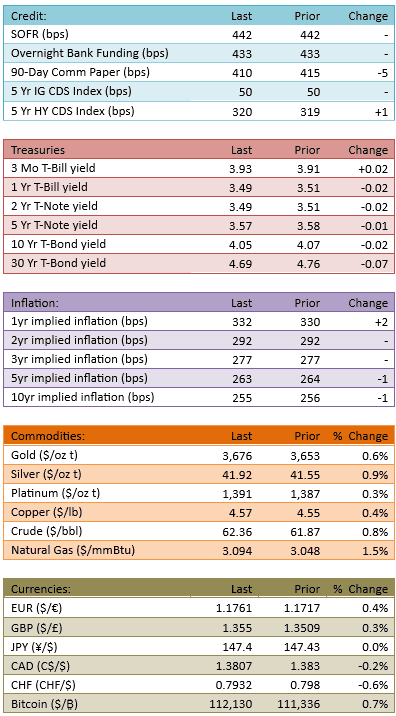

On Wednesday at 8:30 AM, PPI releases (3.3% est vs 3.3% prior). The next morning CPI releases (2.9% est vs 2.7% prior).

Investors are sensitized to the inflation situation and we’re in a situation where we really need a bullseye or a slightly cooler print to get a bullish reaction from stocks. If the print is hot, obviously that’s bad for stocks. If the number is too cool though, that would be just as bad for stocks. It would confirm the view that the economy is slowing sharply, as suggested by the nonfarm payrolls data last week. A too cool set of inflation prints will spike the fear of recession and open the risk-off floodgates.

I don’t know how well the needle needs to be threaded for investors to be happy but I don’t think there’s that much leeway.

In the meantime, markets are bumping around on normal volumes. Nothing to see here.

See you tomorrow.

-Mike

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.