The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

Labor revision.

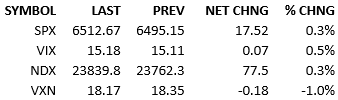

Futures traded up small in the premarket and headlines were tame. The S&P opened up a handful of points and bobbed around +5 until nonfarm payroll revisions came out (-911k vs -682k est & -818k prior). Equities sold off on the release as recession worries jumped into the conversation. Yields climbed, which was counterintuitive, and stocks slowly climbed over the afternoon. Capital flow didn’t reflect anything but a typical market day, printing 101%.

Despite concerns over the labor market’s health, investors went back to their usual business after digesting the data release. The market thinks the Fed will cut rates next week either 25 or 50 bips. The probabilities are currently 90% and 10% respectively. The 50-bip possibility showed up last week and has stuck around since.

It is unclear what the market will do if the Fed cuts 50 bips. Will the market value the stimulative consequences of 50 bips of easing or fret that the economic situation is even more dire than it thought? Fed messaging will have a lot of influence on market perceptions. The Fed release, whether 25 or 50 bips, will move the markets immediately and kickstart all kinds of narratives. However, the press conference will be more significant. There’s a lot of time from now until then but what-if scenarios are bouncing around the Street.

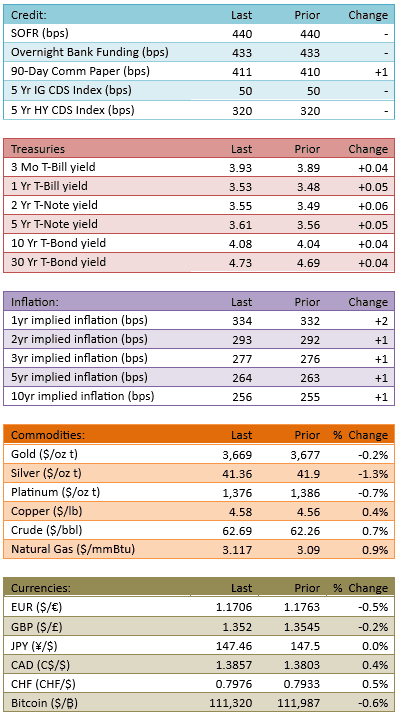

Inflation data tomorrow and Thursday will be significant for all the usual reasons but with economic fragility being front-and-center, I expect markets to be even more sensitive to inflation surprises. Bulls will need a couple of Goldilocks PPI and CPI prints. The odds probably favor Goldilocks prints but the risk is higher than usual.

We’re in a window of macro sensitivity. The key issue is the strength of the economy. PPI and CPI tell us about prices but indirectly tell us about economic activity. That’ll be the lens through which the market sees the prints.

See you tomorrow.

-Mike

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.