The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

Twiddle those thumbs

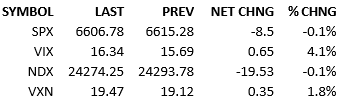

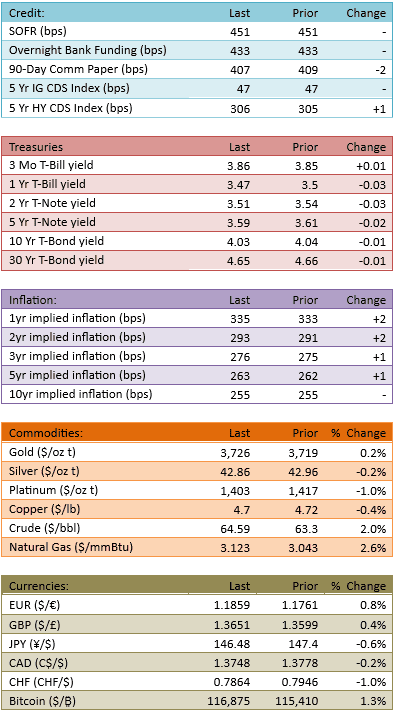

Futures rallied in the premarket again and the S&P 500 opened about +10 points. That turned out to be the high of the day. The index faded early and treaded water from mid-morning until the afternoon. Dip-buyers bought the small dip and pushed the index almost back to flat by the close but lost a handful of points at the bell. Headlines were immaterial and capital flow was a touch higher at 106%. Yields fell small across the curve and most markets appear to be standing around, waiting for tomorrow’s FOMC communication.

Ever since the labor data has been weak, the market has become more and more convinced that the Fed would cut rates in September. Tomorrow the rubber meets the road. A 25-bip cut is almost universally expected. There’s a longshot chance of a 50-bip cut. Markets expect tomorrow to be the beginning of some sequence of interest rate cuts. One-and-done will be poorly received by the markets.

If the press conference convinces the market that the Fed is commencing an easing cycle, bulls will run. If the market worries that the economy is fragile and/or the Fed is behind the curve, bears will eat.

Of course, there are nuances and details galore but the above captures the big picture.

Is tomorrow the start of a credible easing cycle or not?

See you then.

-Mike

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.