The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

We got what we wanted

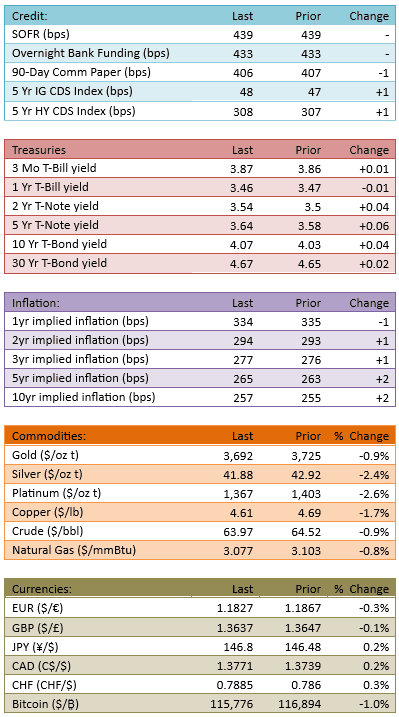

The Fed cut rates 25 bips, as expected. The market zigged and zagged a bit upon the release of the decision. Changes to the statement were pretty unremarkable but the notable change was this “…and judges that downside risks to employment have risen.” The S&P 500 dipped to -50 points at some point during the conference before coming back towards the end. The index finished the day without much of a change. It was a wild-lite ride that allowed everyone to breathe a little bit easier by the time we approached the close. Yields climbed a bit across the curve today and Fed Funds futures expect two more 25 bip cuts over the rest of the year. Capital flow was high at 124%, confirming that investors got active as a result of the Fed decision.

The Summary of Economic Projections (SEP) provided some information to the markets that was interesting. It looks like the median Fed Funds rate for the end of 2025 is about 50 bips lower than now, that confirms market speculations. The projections for rates in 2026 and further out are also lower, to varying degrees. This also confirms market speculations but also shows that the members of the Committee are thinking that a true easing cycle lies ahead. This should be a very bullish bit of news to stocks. Surprisingly, stocks didn’t embrace the SEP.

Some other interesting tidbits from the SEP:

US real GDP was bumped *up*

US unemployment rates bumped *up*

Inflation bumped *up*

Let’s not debate these expectations. Let’s just analyze them.

The Fed thinks GDP will be better. That’s bullish for stocks.

The Fed thinks inflation will be hotter. That’s OK for stocks but really good if the Fed eases along the way, which it expects to do.

The Fed thinks unemployment will be higher. This is *why* they are willing to ease rates.

So we see the Fed telling us that they are willing to lower rates to help the labor market and are less concerned about higher inflation.

As long as inflation stays contained, that should be very good for risk assets for a long time. The risk, as I see it, is a spike in inflation that forces the Fed to return its policy attention to lowering inflation.

As of today, the Fed just told us that helping the labor market by lowering rates is more important than small tick-ups in inflation.

It’s an easing cycle and it started today.

See you tomorrow.

-Mike

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.