The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

What now?

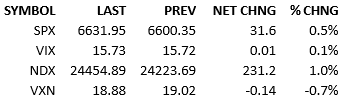

Having slept on the Fed cuts for a night, investors went to work on the long side this morning. Futures were about +30 at midnight and +50 by 8 AM. Headlines were uninteresting and not material for markets. The S&P printed new all-time highs again, as did the NASDAQ-100, highlighting the continuing role of tech stocks as leaders of the bull market. Treasury yields climbed a little but didn’t get much attention from the stock market. Capital flow was heavy again, 120%.

Without a gangbusters headline, investors were left to figure out what to do now that the Fed made the interest rate cut and kicked off an apparent easing cycle. The verdict? Buy stocks. Investors need to allocate capital and they may have been holding back in the run-up to the FOMC decision. With the decision behind us, capital went to work. It makes sense that stocks were a beneficiary of the flows.

If we look ahead a few months or more, we see lower rates and higher GDP and *potentially* higher inflation. That is a less attractive environment for owning fixed income but a nice one for owning stocks. So if you’re allocating capital now, what will you do? You will trim bonds and add to stocks.

The fact that the trend is your friend only makes the decision that much easier.

For US equities, the future is bright. Valuation is high but that never matters until the fundamentals turn. That’s a big risk *when* they turn but they aren’t turning anytime soon.

The economy is getting an assist from the Fed. The economic situation, despite talking-heads throwing shade at each other, has been steady and positive. That fact that things have been humming along for a couple of years, has important implications *when the Fed makes it clear that it will not interrupt the party.*

What am I talking about?

I’m talking about people thinking about buying a home or a car or something else significant. With rates likely coming down, two years of a healthy economy in the books, and no major worries on the horizon, people will increase their economic activity. I don’t think we’re kicking off a 1920s-style era of booming consumerism but I think we’ll ramp up a healthy amount.

Bolt-from-the-blue shocks are the only risks to contend with. Considering that those are omnipresent, asset allocators are looking at an outlook for stocks that is about as fundamentally attractive as it could be.

See you tomorrow.

-Mike

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.