The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

And away we go.

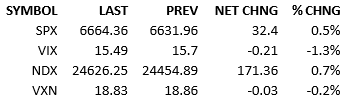

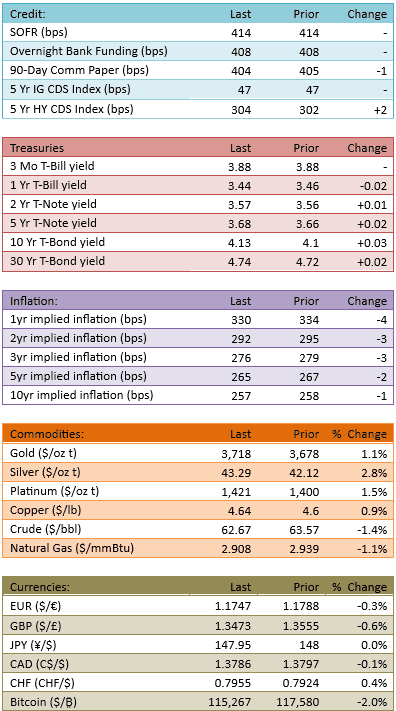

Like so many previous days, the news was a snooze. Futures were essentially flat overnight and in the early hours but they caught a small bid in the 90 minutes before the open. The S&P 500 began about +12 points and faded to unch’d just before lunch. The dip-buyers liked that opportunity and stocks rallied to +18 for the bulk of the afternoon. The index rallied a bit further in the final hour, printing fresh new all-time highs. The yield curve steepened a bit but that didn’t concern equities. Fed Funds futures continue to expect 25-bip cuts in each of the next two meetings.

The headlines don’t give us much to talk about so all we got is the price action. It is bullish. The magnitude of today’s rally was small, as were many previous ones. The consistency of the trend is what’s noteworthy. The S&P is up more than 3% for the month and 13% for the year. Those numbers will do two things for investors between now and year-end.

Without a major event to change the investing landscape, these things will be ever-present forces in the minds of investors. And the more we climb, the more powerful the thoughts will influence the players.

The market has become a big trend-following collective. This is dangerous *when it ends.* But until that happens, groupthink controls the tape.

When in doubt, look at this and ask yourself, should I hop on this thing or fight it?

They say don’t fight the Fed. True. Don’t fight the most obvious and powerful trend in stocks either.

See you Monday, have a great weekend.

-Mike

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.