The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

Old familiar.

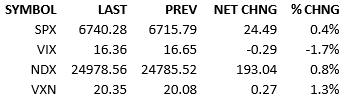

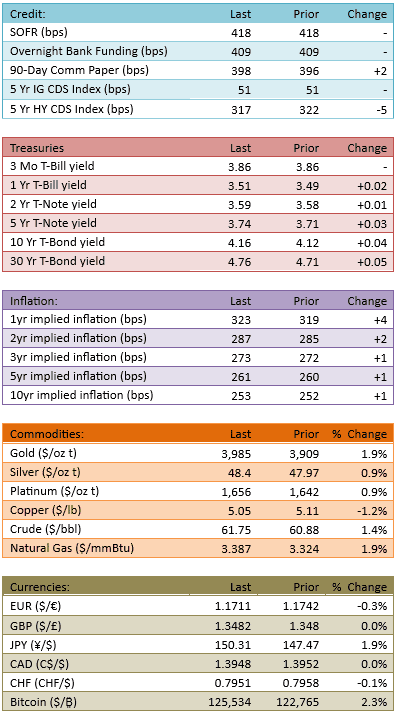

There were few meaningful headlines today. Only Japan moved meaningfully, as a result of their election. The Nikkei surged 4.75%. US futures climbed small in sympathy but our equity market all that influenced. There were headlines about AI deals and headlines about new tariffs and headlines about the government shutdown. The details are different but the general nature of the news is the same. Investors continued to do what they do. The S&P 500 opened with strength, +20, faded early again, bounced in the morning, and stayed bid in the afternoon. Treasury yields climbed a few bips, but that didn’t deter the equity bulls. Capital flow was elevated at 116%. It looks like US equity investors want to push more money into the upside trend.

It's a fresh week without fresh developments worth talking about. The fundamental investment landscape isn’t shifting and so there are no significant things to discuss nor adjustments to make. We are rallying because we have rallied and big tech continues to lead the way.

The next *expected* material event on the horizon is the start of earnings season. JP Morgan kicks off the season with a few other financials on Tuesday the 14th. The large wave of earnings begins on Oct 20th. There are a handful of companies announcing this week.

The risk of earnings season derailing the rally is near-zero. Individual stocks may pop and drop but the narrative for the entire market is solidly established. And without a lot of negative preannouncements, it’s unlikely that reported results will sour overall appetites for equities.

The rally won’t last forever and stocks don’t only go up, but this looks like the smoothest sailing over the next few weeks.

Everyone is piling in to chase the bull market into the final quarter. And I think everyone may be right for a change.

See you tomorrow.

-Mike

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.