The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

The streak ends.

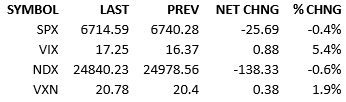

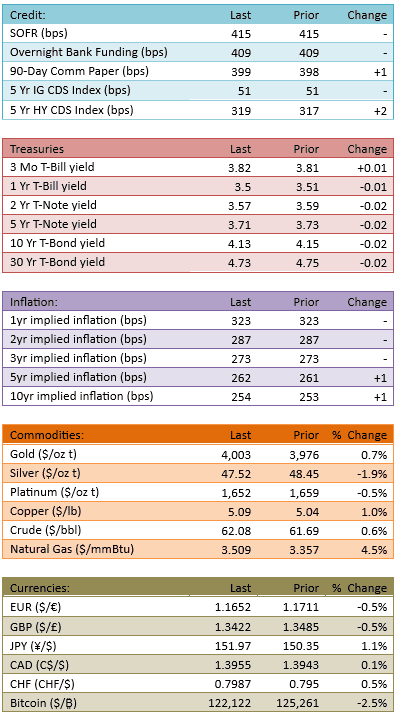

The S&P fell today after 7 previous positive closes. Overnight was quiet and our futures caught a small bid in the premarket. The S&P 500 opened about +10 and the bulls seemed to be in charge again. Treasury yields fell small too, which should have helped the equity longs. The tape sagged slightly early and negative news from Oracle sent the market down further. The S&P stabilized around lunch and bumped along in the afternoon, around -30 points. Capital flow was higher at 117% but nothing suggesting something material.

The Oracle news sent a chill through the megacap tech world and the rest of the market went along for the ride. Evidently the profit margin for Oracle’s cloud computing business is lower than the Street estimated and the whole AI complex came into question. Will compute be as valuable to users as hoped? Will compute deliver sufficient ROI to those building it?

These were the questions asked today. To be fair, they been asked for months. Today, in light of the negative report concerning Oracle, investor’s got a little skittish and engaged in a little risk-off behavior. It’s been quite a while since we’ve seen that and after a 7-session winning streak for the index, it’s not too surprising.

We don’t have good answers to the questions concerning compute by the way. We won’t have good answers for a long time either. The market is attempting to discount what appears to be a very powerful but novel technology. Is the market over or under discounting the value of this development?

The process of valuing AI/compute has been mostly bullish. Today, and back when the DeepSeek news broke, both represent moments when the sentiment of the market delivers a negative adjustment to things. We don’t know whether this adjustment is proper or not. Similarly, we know whether the prior positive speculation was proper or not.

The process is educated guesswork and we will swing with emotions at this stage. We are left to wonder whether today is just a brief questioning or if this is a true revaluation.

I suspect that today’s dip will be bought instead of developing a bearish momentum but we’ll find out this week.

See you tomorrow.

-Mike

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.