The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

Weakness at the open.

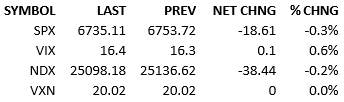

Overnight and premarket futures did their usual. S&P futures were slightly bid by the open but regular hours trading brought out the bears. The index opened +10 points and went negative within 15 minutes. Headlines didn’t seem to be the catalyst but precious metals also slid, and the Dollar notably strengthened. Usually, simultaneous movements across markets are the result of a significant news development but that’s not the case today. For some unclear reason, risk-off began at 9:30 AM and it affected many markets. Treasuries didn’t react too much though so it wasn’t a clandestine fear-trade. Capital flow in the US was 109% so that’s not indicative of unusual investor engagement.

Some back and forth price action in US stocks isn’t a worrisome thing, it just hasn’t happened all that much lately. Perhaps we’re entering a digestion window for the market.

I think it is unlikely that the market has lost it’s love for equities. At some dip level, in the absence of material news, the tape will bounce and the trend northward will resume. In the interim, we could be seeing some portfolio adjustments in real time. I don’t think it’s pure coincidence that 3 major trends reversed intraday together. It could be large institutional players making moves.

Long US stocks, long precious metals, and short the Dollar have all be very lucrative trends. Any big hedge fund in the momentum game will be involved. Taking gains and/or trimming exposure across the board seems very reasonable and logical. And if considering their correlations of late, if things turn, it could be devastating to those players.

In the absence of evidence, I think it’s as good a theory as any.

We are left with one session left in the week and expected news is thin. Maybe if the shutdown ends, we’ll get a kick in the markets but that’s a longshot.

It appears we’ll play some technical small-ball tomorrow. Earnings season starts to get going Tuesday so if preseason hype is going to show up, it’ll have to show up soon.

See you tomorrow.

-Mike

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.