The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

Bolt from the blue.

Markets were quiet and unremarkable until 10:57 AM. President Trump posted on Truth Social that China was becoming very hostile and that he was calculating increased tariffs on Chinese products and that this was due to their sinister move with rare earth controls and that he was supposed to meet with Xi in two weeks but now doesn’t see a reason to meet.

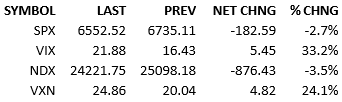

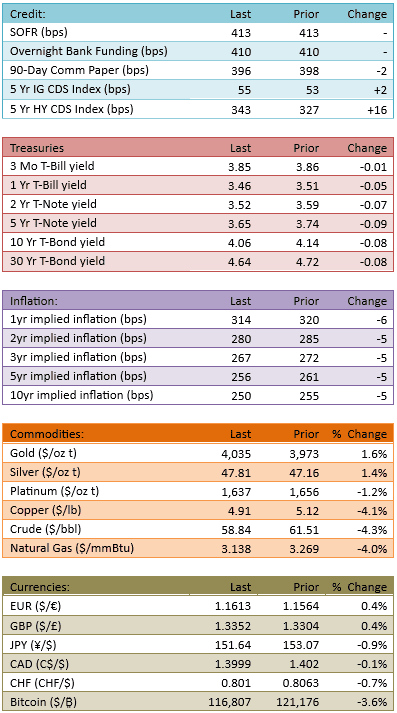

That hit markets like a baseball bat. The S&P fell 60 points immediately and lost over 2% by the end of the day. The Dollar fell, gold popped, and bonds rallied. Capital flow was tracking at 99% beforehand and surged thereafter, finishing at 158%, quite a heavy day.

OK. So earnings season excitement/anticipation just went out the window. We are back in the tariff-talk world and the market is now re-sensitized to the negative possibilities of tariff escalations with China.

Who knows how dicey things will get this time.

The playbook is well known. Tariff-talk earlier this year sent markets into risk-off frenzies and the damage was considerable *but* it was relatively short-lived… and after the fact, everyone realized it was a golden opportunity to dip-buy.

Investors are almost certainly looking at today’s risk-off event and are licking their chops.

The question going into the weekend will be: when’s the market’s worry about this development going to break?

Most longs are looking at this situation and hoping to bottom-tick it.

Your guess is as good as mine but one thing I am very confident about is that if this geopolitical flare-up ends up being brief, the bounce is going to be eye-popping. Once the market suspects that the situation is on the mend, the tape is going to rocket north.

I think the risk at this point is a low probability what-if. What if the rhetoric heats up and negative tit-for-tat result in something *prolonged?*

That won’t result in a dip, that’ll result in a correction, maybe a nasty one. And while dip-buying that may tantalize longs in theory, in practice the pain of getting there will change a lot of their plans. And God forbid if a true trade war kicks off, which triggers a recession.

How many dip-buyers can handle a bear market? I think fewer than they claim.

Will this weekend bring constructive developments between the US and China? Markets will be on-edge sifting through any and all headlines.

See you Monday, have a great weekend.

-Mike

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.