The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

Well, that was quick

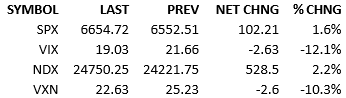

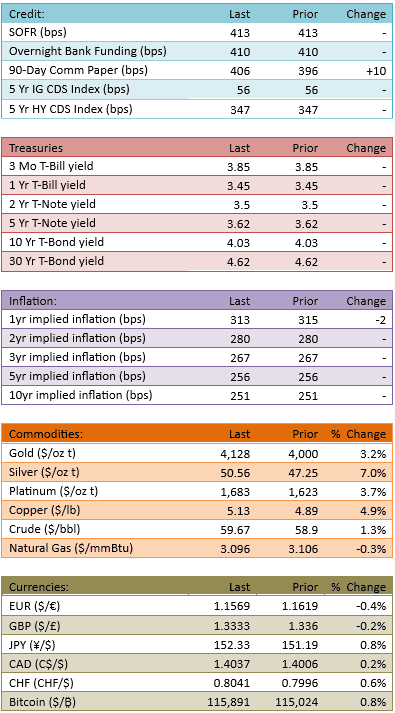

Fears triggered on Friday were soothed over the weekend. President Trump walked back the tension and markets responded quickly and significantly. S&P futures traded +50 points last night and +80 in the early morning premarket. Precious metals rallied multiple percent and the Dollar strengthened. The US bond market was closed for Columbus Day but yields will certainly pop when they do begin trading. The risk-off trade began unwinding last night and continued with gusto through the regular trading hours. Capital flow was slightly higher at 108%.

The dip-buyers win again. The dip was brief but the lesson is the same. Buy early and buy often…. And buy double on any negative news, especially tariff talk.

Markets haven’t quite discounted Trump’s tariff talk as though he were the boy who cried wolf but they are getting there. Obviously there’s a danger in completely discounting what he says going forward but the pattern is pretty clear. I wonder how much risk-off reaction we’ll see the next time. Probably not much.

At some point, *some* bearish development will not be easily dismissed. It will be the real deal. And the dip-buyers who act in that moment will suffer greatly. But until then, the dip-buyers continue to win, and win big. Have they been set up for an eventual calamity?

Probably. But that’s a hypothetical future. And the last, what, 50 years are on their side. Until a true bear market occurs, the permabulls are right and they control the narrative.

Friday’s drama is comfortably in the rearview mirror. Maybe the danger it highlighted is worthy of thought, but earnings season is about to start and we’re about to print new all-time highs.

Are the longs whistling past the graveyard? The bears think so but nobody is listening to them anymore.

It’s back to business for the longs. Get ready for the earnings season narrative to materialize. It’s going to be a mix of awe in the results and optimism for the future.

See you tomorrow.

-Mike

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.