The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

A little different.

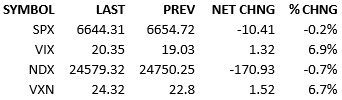

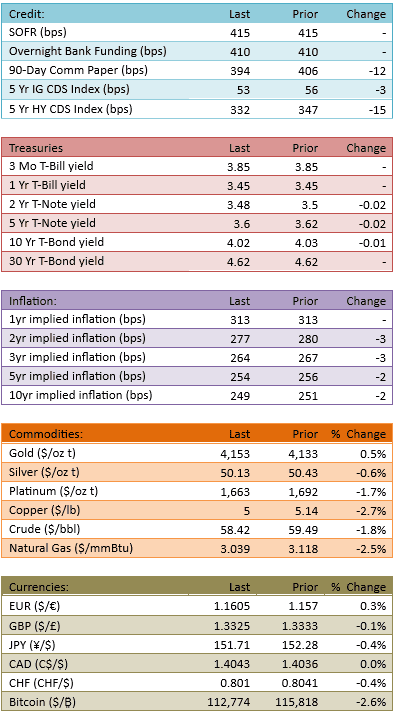

China stirred things up overnight, responding with sanctions on US units of a South Korean shipbuilder. This escalation in tariff talk jolted markets into risk-off mode yet again. The Nikkei fell 2.6%, the Hang Seng fell 1.7% and Europe was off 1.4% around 7 AM our time. S&P futures were down almost 80 points. Concurrently, precious metals were down substantially, the Dollar was stronger, and Treasuries were bid. The S&P opened down 60 points and slipped to -100 within 15 minutes. It looked like Friday’s action wasn’t a lone event but maybe the canary in the coal mine with respect to risk assets. Interestingly, the market bottomed at that point and the tape recovered all of the damage by lunch. Some dovish comments by Chairman Powell assisted with the upside momentum. The index spent the afternoon quietly hovering around the +15 level. Late in the day, Trump sent another shot across China’s bow concerning their refusal to buy US soybeans. That spooked everyone a bit and sent the index south.

Even given the late-session drama, gold was positive, the Dollar finished weaker, and the Treasury curve settled down. Capital flow pumped up a little, 116%.

The US/China tension still matters to markets, as it should, but investors are discounting it, and outright dismissing it, more quickly than ever. The dip-buyers that missed Monday got their do-over this morning and they moved… and they won. Perhaps the market never should have sold off on the response from China? We all should have known that this was more of a face-saving action than a true escalation of a trade conflict.

Of course, it’s easy to say that in hindsight. In the moment, the what-if question is powerful. What if China and the US were about to be at loggerheads? Perhaps China and the US actually want to test each other instead of just bicker?

Even if the probability is small, the cost would be great. Maybe the de-riskers were prudent? Whether they were or not, the dip-buyers took on the risk happily and scratched another victory notch on their portfolios. It’s getting absurd at this point. The dip-buyers aren’t just winning over an extended time. They’re winning within a week, then a day, and now within a session.

What group of US equity investors out there can resist the lure of this indestructible tape?

Obviously, there are some immune players out there but they are vastly outnumbered. The bulk of the actors in US stocks are now reflexive dip-buyers and upside momentum-chasers.

I hate it. I think it is horribly dangerous. It will be unstable eventually. The reckoning will be hideous.

But it doesn’t matter what I think, or like, or dislike, or fear. This market is an unstoppable force. And earnings season is about to spice up the party.

Make hay while the sun shines, they say.

See you tomorrow.

-Mike

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.