The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

Earnings season attention

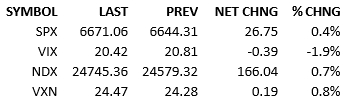

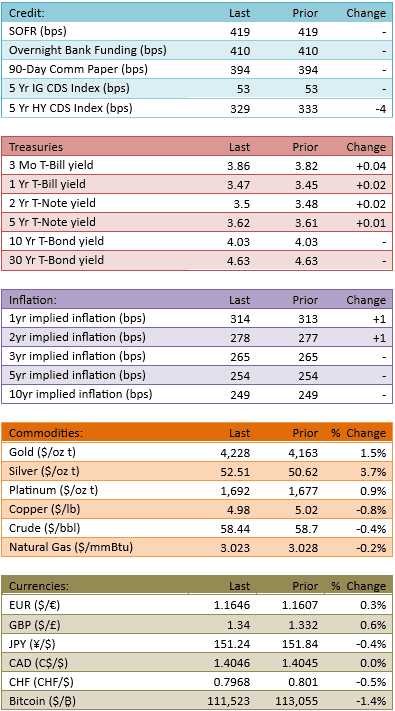

Overseas markets rallied strongly overnight and S&P futures climbed consistently into the premarket. Some big US financials beat and delivered upbeat, albeit cautious, forward guidance. The double-dip of trade worries appeared to be cleanly behind the markets and risk-on was the play. The S&P opened +45, climbed to +75, went briefly negative after 1 PM and returned to a modest gain in the afternoon. The US government shutdown is returning to front-of-mind for the markets as it doesn’t appear to be concluding soon. Markets are not reacting yet, just chattering. Yields climbed a bit across the curve and FOMC expectations remain confident in a 25 bip cut on October 29th, 98% probability.

Bulls are turning their attention to the start of earnings season. The large financials that announced this week snapped investor attention towards the bottom lines of the public companies in the market. Investors were quite pleased with the results and the outlooks. Weakening labor market signals spurred concerns of a teetering economy, barely holding together. Banks and financials would have ringside view of that, should it actually be occurring.

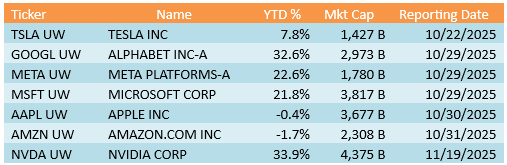

Their verdict is that it is not. Hiring may be anemic but there is no economic decline. Business is booming, or at least expanding. This bodes well for the rest of earnings season. Certainly there is a special place for the megacaps, specifically the Mag 7, but they may not have to carry the water all by themselves for a spell.

If the earnings results, and outlooks, are broadly positive, investors are going to push prices higher in those names and across all sectors. The continuation of the rally will still be strongly influenced by the Mag 7 and tech, but they won’t have to do all the lifting. With lofty expectations for the Mag 7, it’s very possible that they beat but don’t do much for their shareholders. The rest of the market will have to do the work. And as long as the Mag 7 don’t deliver bad news, investors will preserve their bullish outlooks and start allocating capital across the market.

Earnings season appears to be setting up the longs for smiles. When it comes to the risk of the season as a whole, I think there is none until the Mag 7 begin to report. Here are the reporting schedules for the Mag 7:

If I’m right, it’s a cake walk until the 22nd. And if Tesla reports and says good things, it’ll be a cake walk thereafter.

Turning to the government shutdown, at *some* point, a continued closure will be a bearish catalyst. The fact that it is popping back up into the headlines suggests that the market’s patience is running out. Nobody knows when the enough-is-enough moment will arrive for markets. I will speculate nonetheless. I think investors will start to get the fidgets in the last week of October. At that point we will be a week away from another missing nonfarm payrolls data release *and* we will be hearing from the FOMC on their latest rate decision.

The market will start to get worried about how a data-dependent Fed will make decisions without data.

I don’t know how much patience markets will have but I hope we don’t have to find out.

See you tomorrow.

-Mike

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.