The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

Domestic bearishness

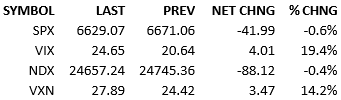

The first half of the day was an exercise in repetition. Overseas markets rallied. Overnight futures picked up a bid in the wee hours. Precious metals rallied. The Dollar was slightly weaker. Yields were essentially unch’d. Earnings reports were all beats. The S&P opened about +20 and climbed a little bit further ahead of lunch. Then Europe closed and things fell apart.

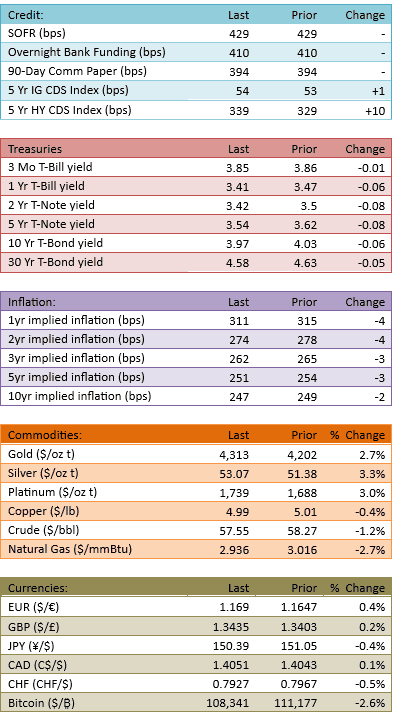

The S&P rolled over around 11:30 AM and went substantially negative an hour later. It spent the rest of the afternoon down about 60 points and capital flow shot up from 105% levels in the morning to 126% in the afternoon. Yields fell across the curve as the risk-off trades moved in tandem, except for the Dollar, that sold off further.

There wasn’t a smoking gun headline to explain the bearish move in US stocks. Some are pointing to loan information coming from regional banks. Whether inspired by a news item or simply a random turn, the bears are now engaged in a slugfest with the bulls. Since Friday, the tape has swung back and forth considerably. We’re experiencing a multi-session consolidation instead of the usual bullish KO, then a multi-day victory parade.

This is behavior from the good old days of trading, pre-pandemic… and pre the everything-rally.

Is this healthy market behavior? Does this suggest the bears will control the tape for a while?

I’m not sure. The unchallenged dominance of the bulls since April has been so persistent that we’ve gotten used to it. We collectively forgot that equities are supposed to chop around much more than they have in the last six months.

From a technical standpoint, last week’s worth of chopping-and-flopping has the index repeatedly testing its 200-day moving average (6557). Hitting that *shouldn’t* be a big deal but it will be. It will ruffle some feathers should it happen.

The initial excitement for earnings season has already disappeared. This is surprising. I wonder if a few more days of quality reports re-inspires the imagination of the bulls and rips the tape northward.

In the meantime, we’re watching traditional market fisticuffs. Don’t catch one on the chin.

See you tomorrow.

-Mike

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.