The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

It’s bumpy out there.

Risk-off gathered significant momentum at 2 AM this morning. That’s an hour before Europe opened. S&P futures fell for two hours, down almost 100 points at the worst. Futures and Europe bounced around 4 AM. There’s no key news item that we can highlight to explain why selling accelerated at 2 AM. General concerns surrounding credit continue to swirl but nothing significant broke on that front in that period. Perhaps some technicals were at play since the S&P futures accelerated lower after piercing the 200-day moving average? As an aside, the Dollar weakened significantly until 2 AM, at which point it bounced considerably. Is the Dollar leading risk-assets now?

There are many questions lingering due to this morning’s action. We don’t know why prices did what they did but they managed to scare markets fairly broadly. It wasn’t too severe but there were a lot of what-is-going-on-out-there questions being asked. A lot of investors were wondering if the market knew something awful that they didn’t.

As newswires lacked scary headlines, investors started to dip-buy. There were pops and drops throughout the day but the bulls finally won-out with a solid rally from 1:45 PM on. Capital flow was unsurprisingly higher at 120%.

What are we to conclude from today’s hijinks? If one only pays attention to the close, the market simply responded to yesterday’s drop. The dip-buyers did their thing and the bull market *should* continue according to plan.

But we shouldn’t ignore the morning’s price action. Since October 10th, the market has been much more volatile than since the April bottom. October 10th was when President Trump resumed tariff talk w/r/t China and its rare earth metals controls. Is that issue at the heart of all this? After the initial scare, investors assumed that it was saber-rattling. They assumed things would work themselves out quickly and quietly and without real impact.

Are investors rethinking that? Is the US/China situation a slow-motion collision that remains in place?

I don’t think so but the issue isn’t *resolved.* It’s possible that markets are tallying up the risks, some unrelated, and wondering if something, anything, could ruin the party.

At the moment, the notable risks are as follows:

Each of these arrived on the scene with small associated risks but as time passes, they don’t appear to be fading. The last two are particularly *more* significant today than they were a week ago. The US/China situation is a riddle wrapped in a mystery inside an enigma.

It feels like the continued existence of all these, seemingly growing risks, is leading to more and more skittishness in the market.

If only I had a crystal ball that told me how these risks would resolve. Sadly we must all wait and see.

One thing is certain. If these risks resolve without impact, today’s buyers will be big winners.

So we should ask ourselves, are these risks showing themselves in small parts, as an advanced sign of pending calamity?

Or are they perceived boogeymen by nervous markets?

I don’t believe there is such a thing as a middle ground on this one. It’s either a big nothing or a big something.

See you Monday, have a great weekend.

-Mike

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

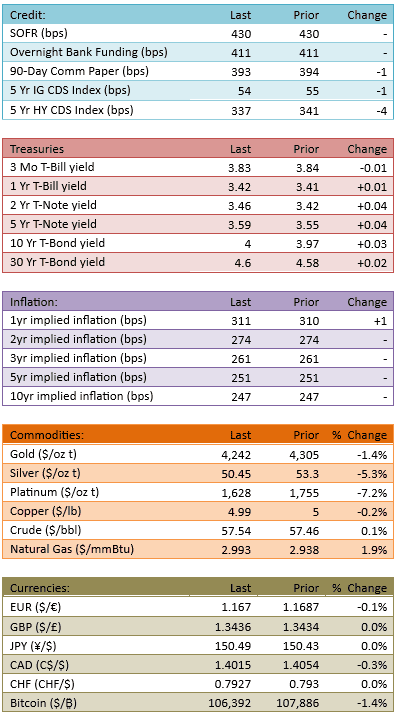

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.