The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

Feeling better are we?

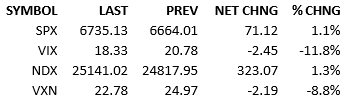

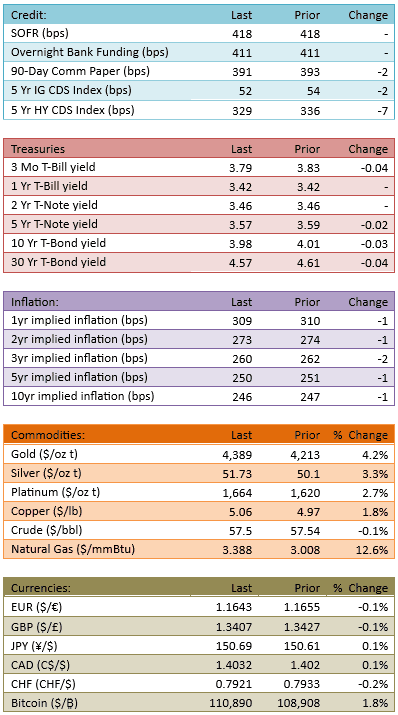

A weekend’s rest must’ve been all the markets needed because the Nikkei rallied 3.4%, the Hang Seng rallied 2.4%, and Europe rallied 1.3%. As a result, our futures traded up nicely in the premarket and the S&P opened about +40. Headlines were benign and noises out of the White House were encouraging regarding the US/China trade squabble. Private credit concerns eased up and a swelling enthusiasm for earnings season is noticeable. Yields came down some across the curve and risk-on trades won the day.

Today’s session was surprisingly uninteresting. The size of the rally was notable but there were no headline catalysts to discuss and the nature of the price action was smooth and steady. It was as though investors treated last week’s drama as a dream and returned to their normal bullish business without a second thought.

The first major wave of earnings season is almost here. Starting tonight, 88 stocks in the S&P 500 will report this week. If there’s an earning season narrative that will take us a few percentage points higher or lower, it’ll form this week.

Here’s how things have gone so far.

40 S&P 500 stocks reported

36 beat EPS estimates, 4 missed

Beta-adjusted:

Not too inspiring so far but this week will matter more than the first batch of reports.

See you tomorrow.

-Mike

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.