The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

Some inflation data

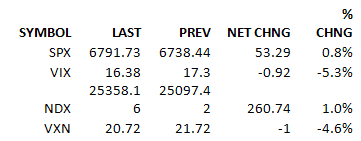

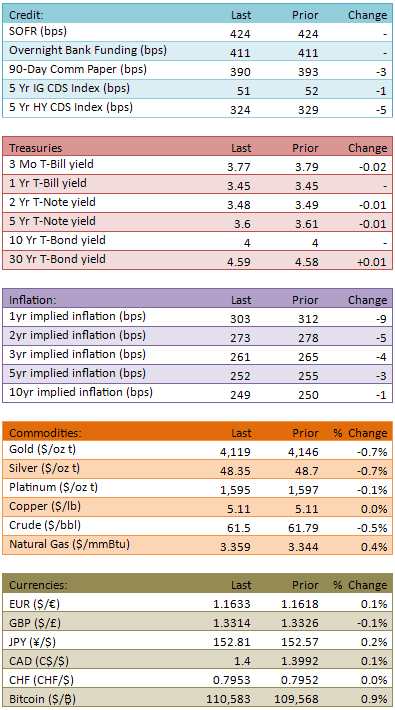

Despite the government shutdown, the September CPI data released this morning (3.0% vs 3.1% est & 2.9% prior). S&P futures were already bid, up about 15 points. The futures rallied 45 almost instantly after CPI. The robots cooled off within a minute and the index opened about +40. Stocks rallied a bit more in the morning and spent the bulk of the session around +60, quite a good day for the longs. The three major US indices hit all-time highs today. Capital flow was surprisingly light at 94%.

The inflation data clears the path for the Fed to ease next week. The market had little doubt that the Fed would cut but assumed some uptick in inflation was part of the cost. That cost now appears to be deferred, maybe even avoided altogether. That’s bullish in the medium and longer term since it suggests that a future aggressive hiking cycle may not be necessary. *Maybe* the Fed can replicate the soft-landing magic they had? *Maybe* they can lower rates 1-2 percentage points without detrimental inflation…. and leave the economy in a healthy low-rate environment? If that’s true, it’s no wonder markets favored stocks today, the valuations can/should climb.

Now the above scenario seems a little pie-in-the-sky, if you ask me, but in the short term, bumping stocks up on cooler inflation data is pretty standard fare. It’s possible that’s all we saw today. I do think that the permabulls are trying to justify higher valuations and the above scenario would do that.

Anyway, whether the US can exist in a 2-3% rate environment without inflation is a question we’ll get an answer to, sometime in the next couple years. For right now, that dream look promising.

We’ve made it to the weekend. Sentiment it rosy. Stocks are at all-time highs. The Fed will cut rates and hopefully deliver some sweet pillow talk next week. Additionally, we hope to be inspired by earnings results from 5 of the Mag 7.

That’s a pretty good setup for a continued rally.

If the US government shutdown concludes as well…. HIYOOOO! We’ll be rocketing higher.

See you Monday, have a great weekend.

-Mike

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.