The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

Enthusiasm.

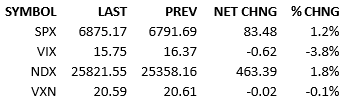

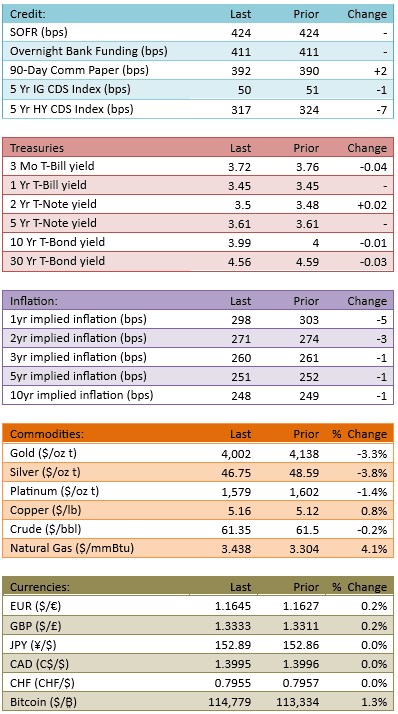

President Trump suggested that US/China trade disputes would come to a positive resolution when he and Xi Jinping meet in South Korea later this week. The mood of markets shifted towards risk-on and moods only improved as the day progressed. Asian markets rallied significantly last night. Europe rallied modestly this morning. We rallied strongly today. Mag 7 and megacaps led the S&P 500 to another all-time high. Capital flow was a touch elevated at 103%.

The US/China trade news is certainly good. Hopefully the announcement of the actual agreement doesn’t disappoint. It’s unknowable what the market currently expects from an agreement. Is the market expecting normalized tariffs on China, or just less punitive tariffs, or a zero-tariff arrangement? The equity mood is so elevated, it wouldn’t surprise me if investors are speculating on a free-trade miracle.

Before we learn the US/China trade details, we’ll get the Fed decision and the earnings results from 5 of the Mag 7. Those are key catalysts for the market but we also will get earnings reports from another 167 stocks in the S&P 500.

That number of corporate announcements make this week the biggest of earnings season, even setting the Mag 7 stocks aside. We’re going to get a whole lot of fundamentally-driven single stock action. If there will be a narrative of the health of the stock market *outside the Mag 7,* it will form this week and it will form without fanfare. It is likely that that the health of the rest of the market goes under the radar this week.

I will share my stats when they come in, both fundamental and stock-performance.

Whether *the rest* of the market is doing well or poorly, it probably won’t change the fate of the index. That rests in the hands of the Fed and the Mag 7. Perhaps it can tell us whether this market is wholly supported by the Mag 7 or simply led by them.

That’s a big difference. I think you can make asset allocation weighting decisions based on that conclusion.

See you tomorrow.

-Mike

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.