The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

Fed wrinkle.

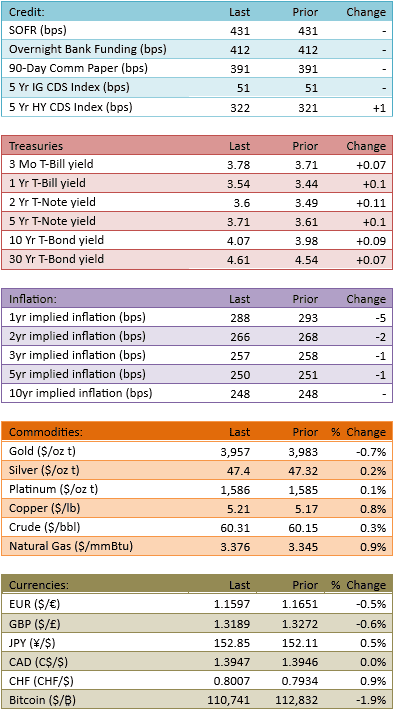

Overseas equity markets rallied, our premarket futures rallied, the S&P 500 rallied at the open. Things were bullish and quiet as we awaited the Fed and its decision. They lowered rates 25 bips, as expected. The released statement had trivial changes. There were two dissents to the decision. One wanted no change and one wanted a 50-bip cut. Markets didn’t really react to the announcement and the statement. It was the press conference that stirred things a bit. Chairman Powell stated that a cut in December was far from a foregone conclusion. This splashed cold water on stocks and bonds, while the Dollar jumped in strength. Capital flow was significant at 128%.

It’s possible that today’s FOMC press conference is pushed to the back burner after Alphabet, Meta, and Microsoft announce this evening….. that said, let’s talk about what there is to talk about.

The Chairman stated in no uncertain terms that a cut in December is not assured. This fits with his tenure. He has always emphasized that decisions are made on a meeting-to-meeting basis. There were a couple of years where data-dependent became a trope of Fed communications.

It would be absurd and probably malpractice for the Fed to state that future Fed decisions were set, or even highly probable. They have to decide what to do in the present. They cannot, nor should they, plan future policy decisions. They must be flexible and no matter how much they think they know what is coming around the bend, they must *respect the possibility of change.* This requires them to always say that the next decision is TBD.

Why the market overreacted to what the Fed Chair said is a little bit surprising. Was anyone in the market expecting the Fed Chair to say “oh yeah, the Dec decision, that’ll be a cut, count on it."

It’s absurd. Even if Powell and every voting member honestly expects to cut in December, they can’t say that out loud. They have to keep that to themselves, let the data roll in and the circumstances play out, and reevaluate at the next meeting.

The market didn’t have too much of a hissy-fit so the Fed Chair’s comments and the markets’ reactions are small stories. For the financial press, this is a big headline. It’s a financial story, almost like financial reality-TV drama, when the Fed tells the market not to be as confident in something as it is…

The actual changes to the fundamental landscape are minor. If the data comes in between now and December 10th such that the Fed should cut, they will cut. If the data is currently trending that way, and continues to trend that way, the market can project a Fed cut with higher and higher probabilities. That’s the way it’s been, it is, and it will be.

There’s no there, there. It’s just a little bit of a soap opera, which is rare for the financial markets and it has the financial press all lathered up.

See you tomorrow.

-Mike

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.