The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

Amazon saves the day.

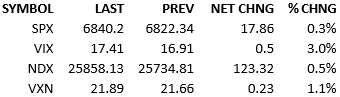

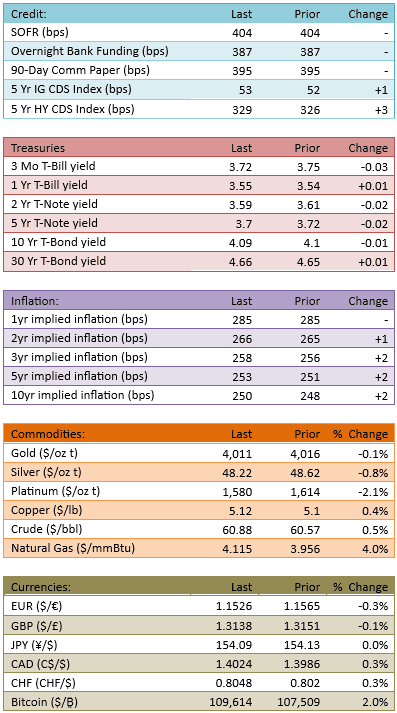

Amazon jumped 10% in after-hours trading after releasing their results. Equity futures jumped higher as well. The bullishness persisted overnight and through our morning. The S&P opened about +75 points and slowly fell over the morning. The index went briefly negative around 1 PM when the dip-buyers pushed the index northward again. Headlines were generally immaterial to broader markets and the positive mood in US equities is mostly thanks to one stock, AMZN. The Treasury curve changed very little and the probability for a 25-bip Fed cut in December is now 64%. Capital flow was high at 119%.

Amazon’s results not only beat the Street but also reassured the megacap/Mag 7 longs that the AI trade still has legs. While the other Mag 7 names had mixed stock performance today, AMZN’s gains were large enough to dominate the rest. AMZN contributed +24 points to today’s S&P change. AMZN also inspired bullishness elsewhere in the market as today’s rally had some broadness. If yesterday gave Mag 7-believers pause, today renewed their faith. Sentimentally speaking, it’s onward and upward.

The month was good for the longs. The S&P climbed 2.3% in October and the nasty fears of October’s poor seasonality can be put to bed this time around. November has been the best seasonal month for stocks by the way so there’s no doubt that bulls of all stripes, especially the technical ones, are gearing up for more upside.

Supposedly 80% of managers are trailing their benchmark. October didn’t let those managers back in. There’s going to be a chase for the rest of the year and today might already be part of that game. Certainly a devastating headline or event will spoil the party but as long as things remain fairly steady, the investing landscape is tilted in favor of the longs.

I continue to wonder when the government shutdown will bother the markets. I assumed that a second missing nonfarm payrolls would cause problems but that doesn’t appear to be the case. We’ll see.

I would also note that *if* the continuing shutdown does trigger risk-off reactions in the market, all the dip-buyers are going to do a dance and buy with both hands. If the market sinks significantly, it will force Washington’s hand, and the reopening will come that much quicker. It will then ignite such a rally, maybe even those underperforming managers will catch up to their benchmarks.

My point is this, the only visible risk is the continuing shutdown. If that stokes market fear, it’ll be the easiest buying opportunity of the last few years.

Buy early

Buy often

Flip your position when the new all-time highs print

See you Monday, have a great weekend. Happy Halloween.

-Mike

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.