The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

Nothing new.

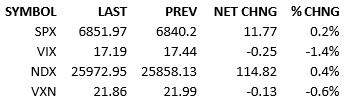

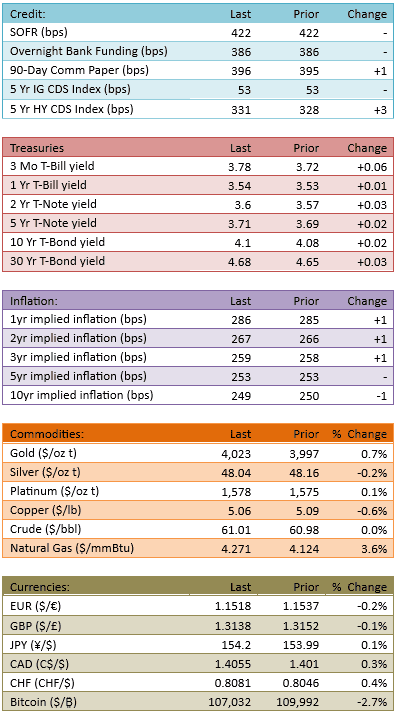

November is beginning without significant news and the market is rallying in the absence of zinger headlines. No news is good news this year. The S&P opened up about 35 points but quickly gave up the morning pop. By the late morning, the tape found some stability in the +10 to +20 point range and hung out there. The equity rally continues in slow motion even though bonds didn’t help today. Treasury yields climbed 1-6 bips across the curve. Probabilities for a 25-bip cut in December are 67%, about the same as Friday.

There’s a bit more chatter in the financial news sphere about the continuing government shutdown and what it might mean should it continue significantly longer. Markets haven’t hinted at concern yet though. At the moment, shutdown implications remain questions posed out loud but neither concerning nor answered. I worry about when the market gets worried.

I also happen to think it’ll be a dip worth buying but I still worry about the fear it will create. If the market gets scared enough to sell off 5 or more percent, it’s easy for me to say “buy that dip” now, in the calm before the storm.

At the hypothetical moment of peak shutdown fear, there will be good reasons to think that things will already be broken and irreparably harmed. The risk of material damage to the economy will be so great that it can’t be ignored *and* that it could actually manifest…. And so we’ll get a nasty selloff

I hate the games of chicken that D.C. and the markets play. Everyone *knows* that someone will blink but what if?

The good news is that nobody is worried. It’s just me and a few talking heads on TV. I hope we’re just nervous Nellies on this one.

That said, we’re heading into a new week with near-zero economic data, no tariff talk, and no shocking global headlines. The track record favors the bulls in an environment like this.

The S&P 500 is up 6 months in a row. It is up about 16.5% year to date. The consensus view is that we’re in the middle of a bull market and the rest of the year will be a continuation of the trend. That may be a naïve view, but it won’t get derailed without a significant catalyst.

See you tomorrow.

-Mike

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.