The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

Risk-off.

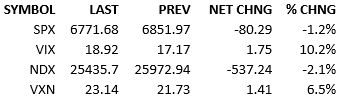

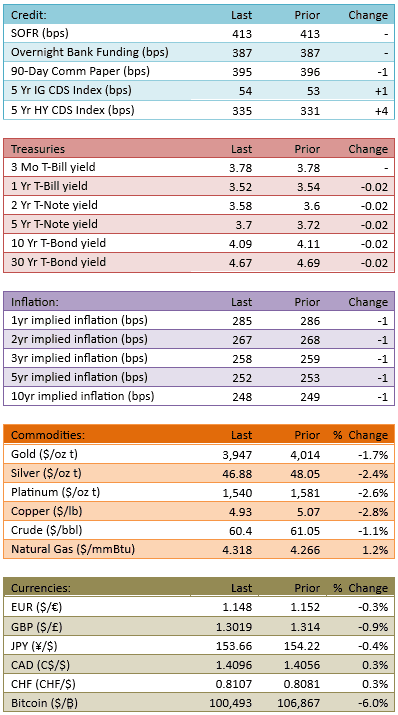

Futures slid gradually overnight and in the early morning. There were no particular events that inspired the risk-off behavior. The S&P 500 opened down about 70 points and dip-buyers went to work quickly, pushing the index to -30 before failing. The index spent the afternoon down 60-80 points. Treasury yields mostly fell, albeit small. The probability of a 25-bip cut from the Fed in December climbed slightly and is now 69%. Capital flow was only slightly higher at 114%.

A 1% selloff should be an insignificant event in the stock market but because this market has gone up so consistently and for so long, markets are wondering what, if anything, is going on. Headlines don’t provide any answers. There were some valuation comments from Wall Street banks that *may* have stoked some bearish inclinations. The government shutdown gets more attention as it continues but it doesn’t appear to significantly affect markets yet. Earnings season is essentially over and talking heads are pleased.

The point is that today was a typical risk-off day but it didn’t have a clear catalyst and that is bothering a lot of investors. The concern is that something under-the-hood is at work. It’s the usual fear at work. The fear of not knowing, of being the last to know. It always shows up when markets move significantly against consensus and without a clear cause.

We’ll have to see how things go over the next couple of sessions but today appears to be a one-off, random spooking of the longs. Perhaps this is a bit overdue as well, technically speaking.

But if we circle back to earnings season, there might be something under this hood worth considering.

In the S&P 500:

341 S&P 500 stocks reported

291 beat EPS estimates, 47 missed, 3 met

167 stocks rose, 173 fell

-0.1% avg

-0.1% median

Beta-adjusted:

169 stocks outperformed, 172 underperformed

0% avg

0% median

These are meh results. Shareholders were not rewarded this season. This is unusual. Most seasons have meaningful outperformance.

If one looks at the percent of stocks that beat the *estimates,* it’s 85%. That’s a very high number. On its face, this should be a wonderful earnings season. And that would be true, if beating the Street estimates were what mattered.

But the performance tells us something else. Was the market ahead of the fundamentals? This conclusion doesn’t force a price reaction going forward but it certainly doesn’t make me bullish in the short-to-medium term.

Maybe November won’t be a bullish cakewalk.

-Mike

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.