The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

Greenland?

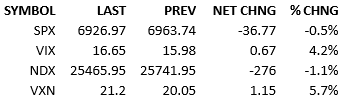

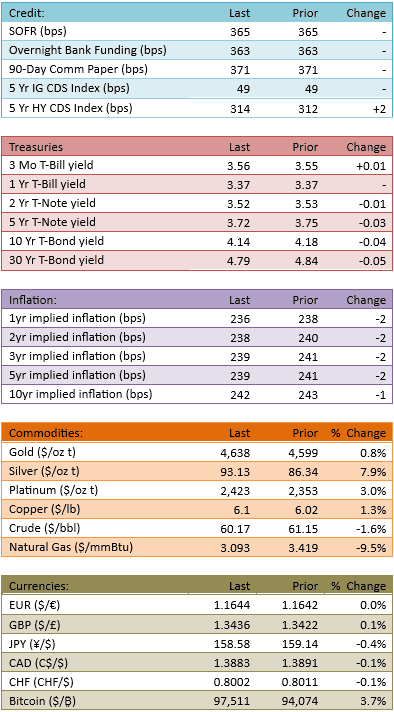

Overnight futures traded down about 10 points before prices slid significantly. The S&P 500 opened down about 30 points and lost more value in a back-and-forth process through the morning. We bumped along the intraday lows in the midday, down about 70 points then. Bulls repaired about half the damage in the afternoon. Yields came in a few basis points along the Treasury curve, resulting in a flattening. Whether that’s a sign of economic/geopolitical concern or a welcome change in the bond market’s outlook, is anyone’s guess.

The bears won the session but and while the Trump rhetoric concerning Greenland is terrifying on its face, markets are mostly brushing it aside. It does seem like investors are hoping Trump will back off on the aggression and/or recharacterize what he wants in a negotiation-based framework. He’s not cooperating…yet. And perhaps that’s something causing the risk-off trades to gather momentum. Certainly if Trump gets more belligerent w/r/t Greenland and his demands, markets are going to suffer. The converse is true as well. If Trump reframes the Greenland issue as something that can be negotiated, with Denmark and Greenland, in a mutually agreeable way… well then the bulls are going to benefit. We’ll have to wait and see.

Other issues in the market are percolating as well. The credit card cap is putting fear into the financials. That issue too will resolve favorably for the longs if the 10% cap can get horse-traded away for some other desirables in the bill, like the ability to provide multiple channels for transaction processing. Anyway, until some details pop out, the fear will be present and financials will trade heavy.

Earnings season is on the back burner, for the moment. At some point, one expects that to change. Who knows what event in particular will move it to the front. It’s only a matter of time. The narrative surrounding earnings season remains optimistic. That could change but seems on good footing currently.

See you tomorrow.

-Mike

Visdom Market Commentary

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.