The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

Some optimism

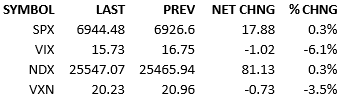

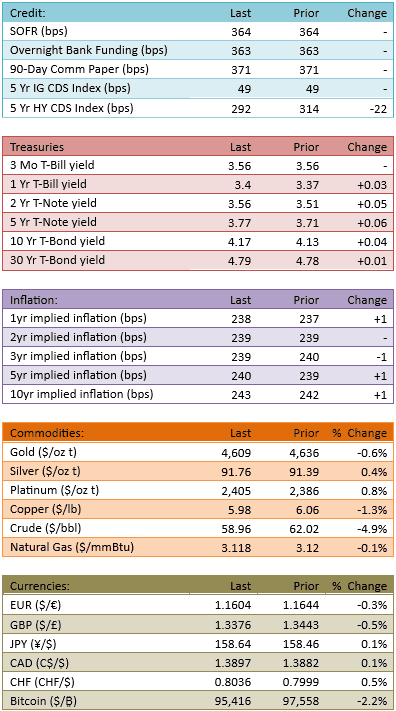

Futures climbed some in the wee hours and set the stage for a bullish session. The index opened about +40 and climbed somewhat further by lunch. The index came within 5 points of a new all-time high but rolled over in the afternoon, retracing about 45 points. The day finished with a small gain, a weak but welcome answer to the last two down days. Yields didn’t move much but they did go from down in the morning to up at the close. Capital flow was slightly elevated at 109%.

Goldman Sachs, Morgan Stanley, and Blackrock announced their earnings this morning and all three results were rewarded by the market, each stock climbed 4-6%. Even though the financials didn’t lead the market higher today, the sector did gain. Considering its overhanging issues, this is an important change. This could be a signal that the market is looking to brush most other news aside and concentrate on corporate results. If true, this is a bullish turn.

We might not be off to the races just yet however. We are still waiting on the Supreme Court and its decision concerning the President’s tariffs. We don’t know when the decision will come. It was initially expected last Friday. I don’t think the delay can be interpreted one way or the other. It’s a day-to-day item and markets are waiting for it, but not anxious about it. When the decision does arrive, it will push investor attention, at least for that day, to the macroeconomic landscape. Earnings season will move to the back burner again.

Maybe that allows for opportunities among the single stock pickers out there? Something to keep in mind if you have a few favorite names.

Anyway, markets don’t have much conviction currently. They are moving small and without persistent momentum. The latest sentiment shift is nice for the longs but if they are hoping for big percentage moves, it’s going to require some headline assistance.

See you tomorrow.

-Mike

Visdom Market Commentary

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.