The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

No Greenland issues anymore

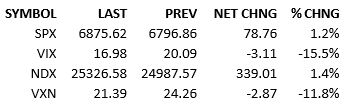

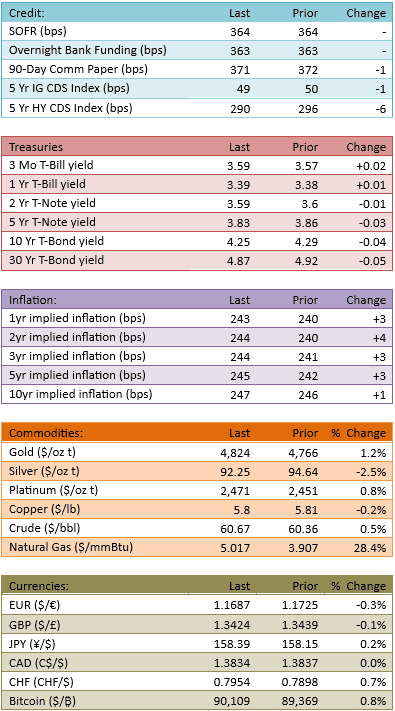

Overseas markets were mixed small and S&P futures were up small ahead of regular trading. The index opened about +20 and rallied significantly further as President Trump spoke at Davos. The key moment of the speech was when Trump stated that he would not use force w/r/t Greenland. Risk-on markets rallied quickly and strongly as investors assumed that was the beginning of the end of the worries. Somehow, negotiation would result in a reasonable outcome. Markets rolled over again though as worries about the brusqueness of Trump’s language and policies took hold. That concern didn’t last long however, since President Trump announced a framework of a deal and a cancelation of all the threatened tariffs just before 2:30 PM. Risk-on markets zoomed on that news. The S&P was +110 points by 3 PM. It did give back some in the final hour. Treasury yields fell nicely across the curve and capital flow was heavy at 138%.

What a day.

So the Greenland issue came out of nowhere with the usual Trump bluster and only when Trump made threats above and beyond his usual level, did both markets and countries worry. Once the worry became significant, President Trump backed off and erased the problem altogether. Markets have labeled this TACO, Trump Always Chickens Out.

I don’t know about that. Trump has a very off-putting means of negotiation. He threatens to break things, scares the counterparties (and sometimes his own side), and then announces an agreement that smooths things along.

I don’t praise the method of his madness but certainly has a pattern. The problem is that markets are wise to it. The markets and counterparties no longer react to usual statements. They now react to *escalating* threats. Trump had to threaten an *invasion* of a NATO country this time around. That’s crazy. What’s going to happen next time?

God forbid Trump ever seriously commits do go down one of these extreme paths. The markets must worry about each what-if scenario, always. Markets cannot dismiss Trump’s comments as exclusively empty. If he threatens X, the market must discount X.

Where does this leave us?

It means volatility is going to *increase* and stay elevated for as long as Trump is in office. His rhetoric has to prompt people to worry. That’s going to mean it gets louder and more consequential along the way. Hopefully it never actually comes to pass but in each instance, markets will have to price in the chances that it does.

That means asset prices are going to *swing*.

See you tomorrow.

-Mike

Visdom Market Commentary

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.