The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

All clear

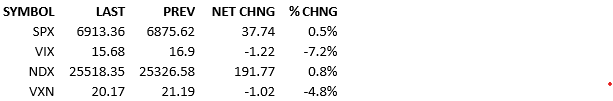

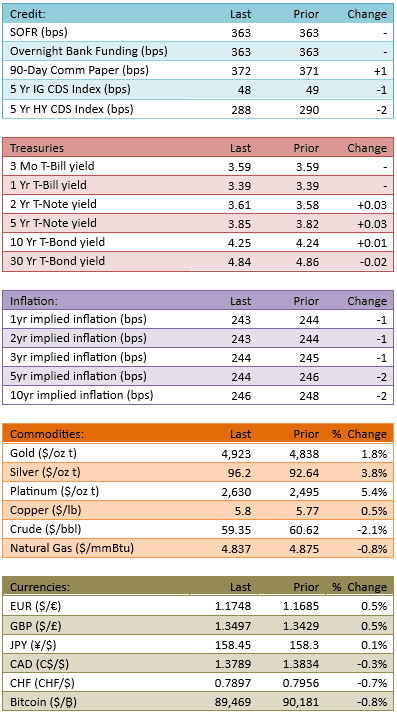

Overseas markets rallied nicely in response to us yesterday and our futures traded up modestly in continuation. Greenland news has completely morphed and headlines have zero negative tone. The positive outcomes of the future US involvement with Greenland are popping up in the press. US macroeconomic data released this morning paints a healthy picture of the US economy and bulls are back in charge of equities. The S&P 500 opened about +40 and it rolled around a bit over the day, but always staying positive. Meta led the Mag 7 and the Mag 7 led the market. The yield curve flattened a little and capital flow was a bit higher, 106%.

Sentiment is shifting from relieved to optimistic. The Greenland dip is behind us and the usual players are getting long quickly, in an attempt you get in before we print new highs. For the S&P that’s 6986, not too far away. The best way to describe yesterday and today is by calling it a relief rally. However, it quickly will become a momentum rally.

Earnings season is ramping up and investors can now turn their attention to the results, which are pretty good. So far, the reporting stocks haven’t wowed the market but as results come in, investors will embrace the health of corporate results, which will lead them to lift offers. I don’t know if it’ll become a messy food fight to the upside. I suspect not.

I do think we’re heading for a pretty good stretch of upside. Investors are going to stop worrying about valuations, take comfort in the growing corporate revenues and earnings, and *begrudgingly* allocate capital to US stocks. It’s going to be a process. Investors are going to be better buyers for a while, the rest of earnings season if I had to guess.

Where else are they going to put their capital? The most recent danger has passed. The health of the economy is good. The drumbeat of the bull market and the slow ascent of the market wears away at the patience of the sidelined capital. It’s going to go in, slowly and steadily. And dips will be bought.

The lesson was relearned for the umpteenth time last week. Nobody’s about to forget it in the short run.

See you tomorrow.

-Mike

Visdom Market Commentary

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.