The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

Fed non-drama

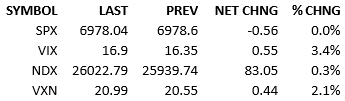

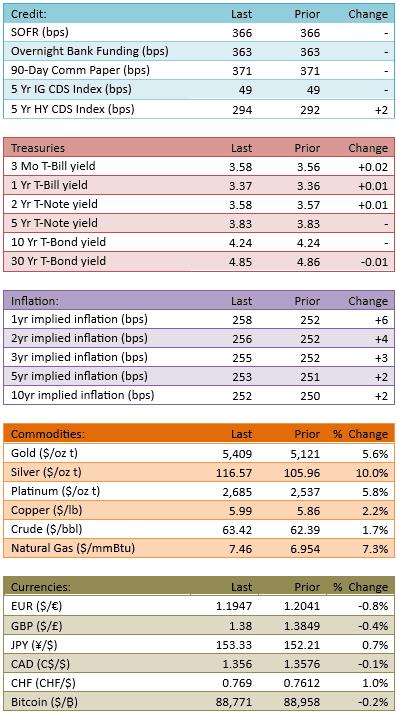

The Fed didn’t change rates, as expected and the Chairman didn’t say anything to stir up the markets, as expected. The S&P opened about +20 this morning and printed new all-time highs (7002) shortly thereafter. The index gave it all back by 11:30 AM and then hovered down slightly until the FOMC decision. The index recovered to flat and stayed near that level for the remainder of the day. The yield curve did very little. The Dollar strengthened significantly, on the heels of comments from Treasury Secretary Scott Bessent. Capital flow was higher at 117%, indicating *some* combination of factors were more motivating than usual today.

Barring an economic shock, the Fed is now in a holding pattern. The market only expects a 25 bip cut around July and only expects 45 bips of total easing for the rest of the year. This will all change, for certain, when a new Fed Chair is announced and then confirmed. At the moment, the market does not expect a new Chair to disrupt existing policy. There’s no sense in guessing what’s coming however (in my opinion). Whoever Trump nominates, the market will quickly express its opinion. And even after the market speaks up, and the candidate is confirmed, that person could always surprise the market, positively or negatively, once they hold the position.

My point being, until we know the person, we don’t know what’s coming. And even after confirmation, we still won’t know how the Chair will act until their first FOMC meeting. There’s no sense worrying or celebrating right now.

Moving along, we’ve got earnings season, which is getting no respect. The market has not characterized the season as either good nor bad. We continue to wait for something that allows the market to latch on to a narrative. Microsoft, Meta, and Tesla announce tonight. Maybe they are the catalyst.

One other observation. This is a sneaky bull market so far. The S&P is up 1.9% for the month and small caps are up 6.9%. The sectors of energy, materials, and consumer staples are up 11%, 10%, and 7% respectively.

We haven’t had big rip-roaring rallies, just price action that resembles 2 steps forward and 1 step back. The rally has been broader than last year too.

Is this a good sign or bad… or insignificant? I’m not sure but it’s different.

See you tomorrow.

-Mike

Visdom Market Commentary

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.