The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

Divergence

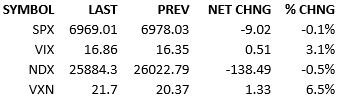

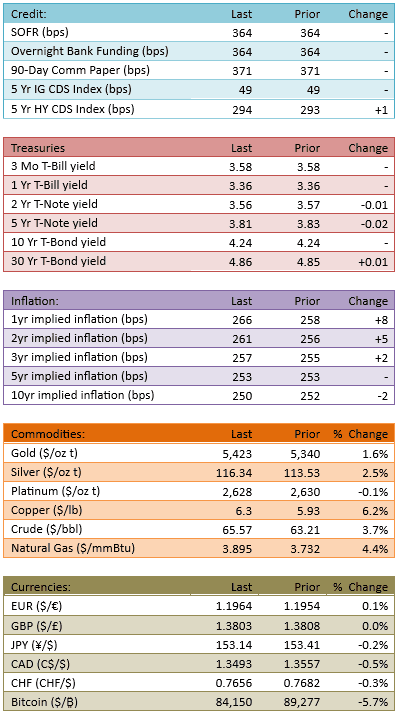

Overseas markets were calm and our premarket futures traded up small. The S&P 500 opened up about 10 points and started dropping immediately. The index fell in a couple quick moves, with a particularly sharp drop around 10 AM. The index bounced at 11 AM, down 108 points. Things were pretty ugly but dip-buyers came to the rescue and repaired most of the damage over the remainder of the session. Microsoft fell 10%. Tesla fell over 3%. Meta rallied 10%. That’s a big divergence among the Mag 7 reporting stocks. Bitcoin fell substantially today, down almost 6%. It too experienced a fast drop around 10 AM. The yield curve didn’t move much, coming in small. Capital flow was heavy at 154%.

Earnings season doesn’t have a narrative yet, which is surprising considering the disappointments that Microsoft and Tesla delivered. One would have expected investors to craft a narrative as a result. That’s not the case. The earnings season vibe remains surprisingly neutral. The view has become very stock-specific. Investors are not broadly buying or selling the market as the earnings season goes on. They are buying and selling the reporting stocks in isolation. Industry and sector rotations are also being inspired by individual reporting stocks. This is not surprising. Investors are shifting their capital *within* the market as a result of this earnings season but they are not shifting capital *into* nor *out of* the entire equity market.

As a result, we have no bullish nor bearish trend for the market. It’s unusual. I suspect that the broader market will not trend significantly for the duration of earnings season. We may drift higher, which is my guess, but I don’t think we’re going to take off with force. There will likely not be a fear of missing out rally.

The hopes that Mag 7 would lead the market higher in leaps and bounds are dead. However Meta shows that the situation isn’t bearish either. We have winners and losers to sort though this season and one cannot just buy everything and experience a seasonal benefit.

See you tomorrow.

-Mike

Visdom Market Commentary

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.