The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

Kevin Warsh

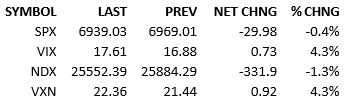

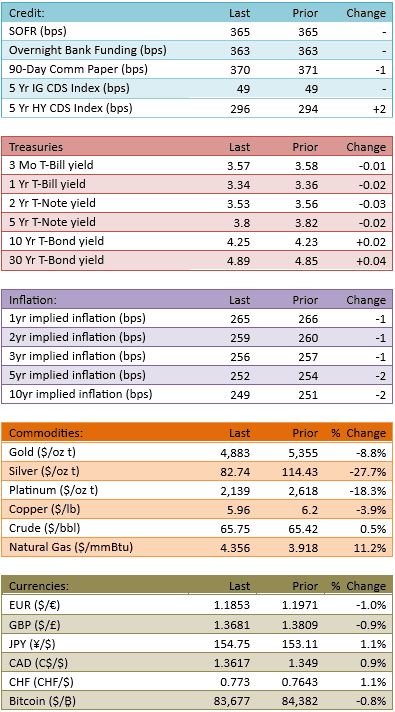

Trump announced that he would nominate Kevin Warsh for Fed Chair. He is viewed as a competent hawk. He is viewed as willing to drop rates early, perhaps in deference to Trump, but the market also expects him to act hawkishly should inflation rise. Precious metals crashed. Gold fell 9%, silver fell 28%, platinum fell 19%. The Dollar strengthened and the yield curve steepened a little. The S&P 500 opened down about 20 points and was off as much as 76 by the afternoon. The tape recovered some later but the bears chalk up a respectable win for the day. Capital flow was heavy again, 144%.

The narrative that Kevin Warsh is the reason for the precious metals drop is an exaggeration. The inflation swaps market came in 1 basis point across the curve today and the Treasury curve steepened 5 basis points from the 1 month T-Bill to the 30 year bond. The Dollar strengthened almost a percent. Those markets are not telling the world that inflation is about to die, or maybe even go negative. If precious metals’ recent trend higher were just about inflation concerns, they would not have fallen as much as they have. Those metals appear to be correcting from insanely overbought conditions and it would not surprise me if a lot of today’s selling were due to margin calls on the futures positions that make up that market.

Anywho, the point is that the story behind today precious metals collapse is not the true story.

Returning to the stock market, the S&P finished up about 1.4% this month. This is not a rip-roaring continuation of last years rally, but it’s still a respectable win for the longs. Earnings season hasn’t been inspiring but it hasn’t been a bearish event either. Interestingly, volatility has returned to stocks. It seems like things are dicey but that’s only because the relatively calm of the last year lasted so long. Swings in stocks like we’ve seen lately are the historical norm. Perhaps that’s a counterintuitive bit of evidence that the US stock market is actually doing OK.

Have a great weekend, see you Monday.

-Mike

Visdom Market Commentary

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.