The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

Mega tech

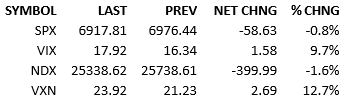

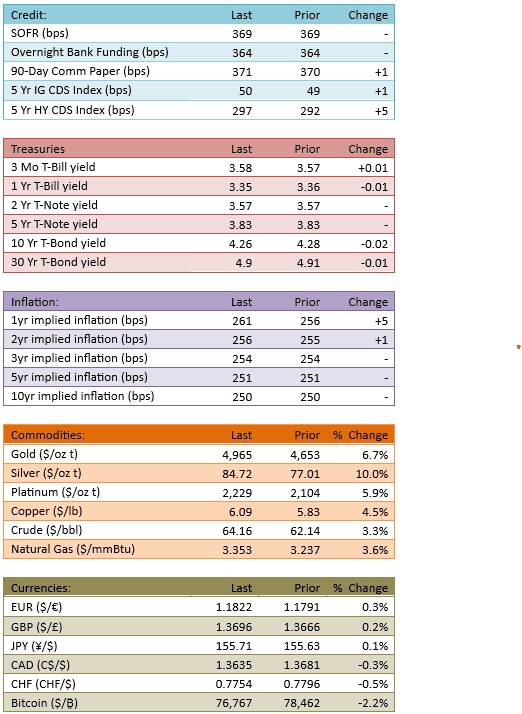

Today’s drop was a regular trading hours affair. The overnight and premarket futures were slightly bid. The S&P 500 opened up small. It drifted into the red just before 10 AM and kept going for four hours. The index was down 1.6% at the lows. Big tech was the culprit, especially some of the Mag 7. Interestingly, Bitcoin’s trading pattern today matched the S&P. A strong linkage between Bitcoin and US stocks hasn’t been around for a while. As a sign of the heightened risk in the market, US Treasuries benefited with a very small flight to safety bid. Later in the day, helping the dip-buyers, news out of D.C. broke that the US government shutdown should end shortly. Capital flow was heavy at 146%.

Supposedly a new AI automation tool, created by Anthropic, threatens to compete with many existing software makers and software service companies. This concept that AI will cannibalize the most tech-savy firms first, is an interesting new narrative in the AI story arc. Why this story gathered attention today and where it will go, is anyone’s guess. However, until the market either rejects the narrative or modifies its existential consequences, it will be difficult for tech to resume its bullish trend.

I don’t have good insight into this particular AI issue but it strikes me as a new variant of the AI story we’ve already seen. The power of AI is first perceived to be destructive. Remember how it was going to put programmers out of work? Then the narrative shifts somewhat towards constructive. Now AI makes programmers more productive. Or so the current story goes.

Perhaps the AI-will-kill-software-companies story is just history rhyming with itself. Maybe in the future, the story becomes something along the lines of AI-will-improve-software-company-efficiency?

I’m just speculating of course but there’s something about the market’s (and the public’s) narrative-creating arc that seems at work. First reaction is doomsday, then something less horrific, then something potentially positive.

I’m not sure whether I’m seeing the psychological parts of this correctly, but if I am, the changing of the narrative will be things to watch for. Even in the last couple of hours, the market is backing away from the Doomsday concern. If interpretations of positivity start hitting the newswires, we could be looking at a true FOMO rally.

See you tomorrow.

-Mike

Visdom Market Commentary

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.