The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

Is it Bitcoin?

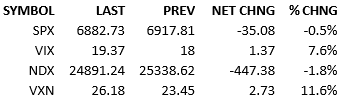

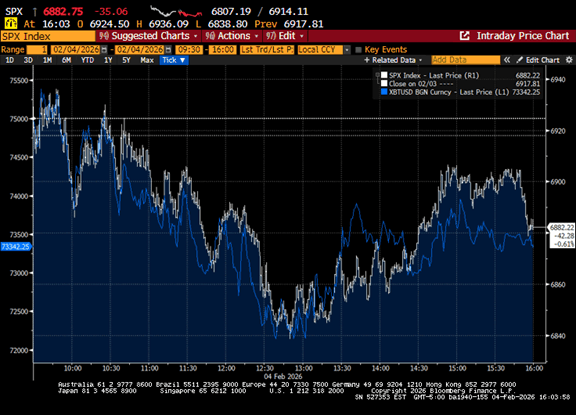

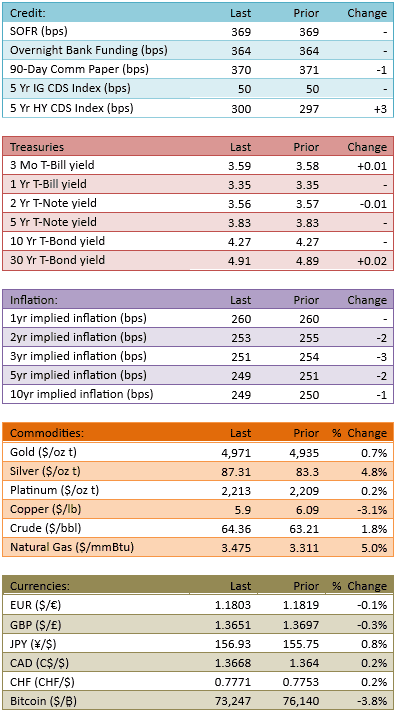

Like yesterday, today’s bearish outcome was a regular trading hours phenomenon. Futures were slightly bid in the premarket (again). The S&P was slightly positive in initial trading (again). The S&P went south fairly quickly and kept dropping until lunch (again). The index recovered a good chunk of the max pain in the afternoon (again). It’s like a re-run of yesterday. Today’s yield curve steepened a little. The Dollar strengthened a little. Capital flow was heavy again, 161%.

The stocks that led the market down today were 5 of the Mag 7 as well as a few other big tech names, AMD, AVGO, and PLTR being notable. Tech was the lagging sector of the day and while AMD’s disappointing guidance had everything to do with AMD, it also may have had a spillover effect. Expectations of AI-driven results are so high that if the dreams of the Street aren’t being met (or encouraged), prices get punished. This is certainly healthy in the longer term but in the short term, it’s just painful for everyone.

What’s really curious however is that even if the discounting of future tech results is what’s going on….why the heck is Bitcoin tracking with stocks so closely lately? If the tech complex is experiencing a haircut for fundamental adjustments, what is Bitcoin experiencing at the same time, on an almost tick-for-tick basis?

Here’s today’s intraday chart of the S&P 500 and Bitcoin. This is some highly correlated price action.

What is going on?

There is no clear fundamental linkage between the crypto space and the tech space… but there is almost certainly an investing linkage. High-risk, high-return capital has been very well rewarded over the past few years. And when someone says, allocate *this* capital in the high-return space, it gets divided up…some goes in tech stocks and some goes in crypto. I’m sure some goes into emerging markets and other places (commodities maybe?), but the bulk goes into tech and crypto. That’s where the eye-popping returns have lived and that’s where high-octane capital gets placed.

Now, there’s some unwind happening. For tech, it’s fundamentally driven. For crypto, it’s just part of the flow.

At some point crypto will react to its own fundamentals. I don’t know when that will happen. I also don’t have a view on what the fundamentals of crypto are, so I can’t suggest buying its dips nor selling its pops.

I will say this. If crypto keeps going down after tech eventually stabilizes, investors will start making distinctions within the high-octane capital bucket. Right now, it’s all part of the *high-risk* allocation. At some point, investors will focus on the particular *slices* within their high-octane allocation.

That point will show up as a break in the correlation. I wonder when it will happen?

See you tomorrow.

-Mike

Visdom Market Commentary

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.