The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

Getting messy.

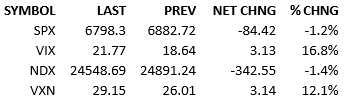

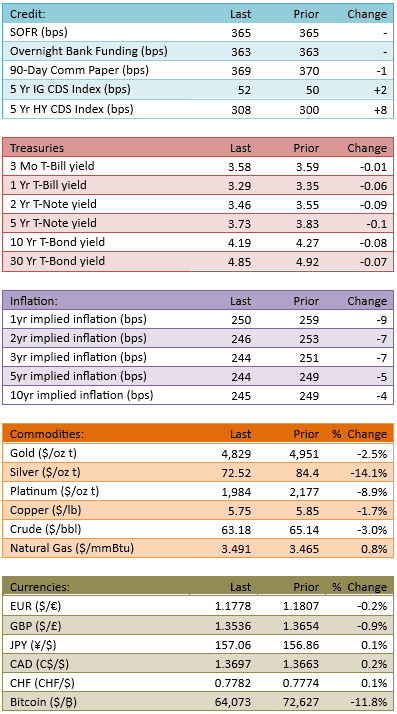

The risk-off play continues. It continues to derive its energy from US regular trading hours though, which is curious. Premarket futures were higher until 7 AM, when the Bank of England kept rates steady, as expected. About an hour later the European Central Bank kept rates steady, as expected. Despite the non-surprising outcomes, investors started to get the jitters that *maybe* central banks should be easing to help boost the economy. Suddenly, preemptive action to head off a recession, became a narrative. Anyway, worry took hold and the S&P opened down about 60 points, the selling gathered steam and the S&P was off 100 points by 10:30 AM. The index recovered some by lunch and wandered around the down 1% level all afternoon, slipping further into the close. Bitcoin dropped all day. It fell down badly late. Additionally, the flight-to-safety showed up. US Treasury yields were down significantly across the curve, from 1 bip on the front to 7 on the back. Unsurprisingly, capital flow was heavy, 147%.

Where to begin?

Unlike many risk-off episodes, today’s is not triggered by clear catalysts. We have a mix of concerns that popped up, from overspending on AI to employment weakness to collateral damage from crypto. The particular risk of the larger narrative is not terribly important for us right now. What matters is that the markets are *worried* and they are getting more nervous about *unknown* risks as prices drop.

Forget whether stock valuations are proper and forget whether the dip-buyers will turn everything around and forget the narrative that we’re in a bull market. In this moment, emotion is driving this ship. That usually is a call to arms for bulls but that’s not necessarily the right call. Emotion can be justified and doesn’t have to be ignored.

The key to today, and the last few days, is that markets are wondering if something big and negative is coming… but they don’t know what it might be… and with persistent weakness in the tape… markets increasingly worry that *some* people already know something bad that the rest of us just don’t know, yet.

This atmosphere of concern, worry, and fear feeds on itself. Sometimes it’s delusional. Sometimes it’s justified. We don’t know what the current atmosphere is. Therefore it is very dangerous to assume that the fear is wrong and pile in long or assume the fear is a harbinger and dump all your risk.

I am not suggesting one does nothing. I am suggesting that you understand that the current market isn’t reacting to a policy error, or a pandemic, or any meaningful fundamental event. This is a collective emotional behavior. Knowing that, one should make forward-looking decisions, not carbon copies of past ones. One should also act incrementally.

There are old traders and bold traders but no old bold traders.

That applies to all investors, actually. Act accordingly.

See you tomorrow.

-Mike

Visdom Market Commentary

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.