The opinions expressed below are my own and do not necessarily represent those of Visdom Investment Group, LLC.

Everybody back in the pool

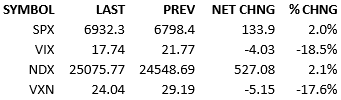

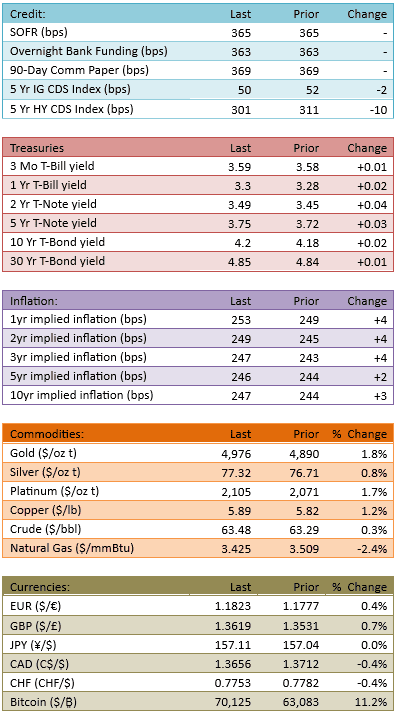

S&P 500 futures traded up at 4 AM and they never looked back and the bears never had a chance. News wasn’t material today so there’s no story behind today’s upside. The index opened about +20 and was +60 within 5 minutes. The index consistently climbed further over the day and was +100 by lunch. The index looked squeezed towards the close, for what it’s worth. Treasury yields climbed. Bitcoin rallied over 10%. The tech sector led all others, by far. Whatever went down yesterday seems to have rallied today.

The dip-buyers get to declare victory yet again. Apparently, the last week and a half of skepticism and worry was just a bad dream. Today’s rally was a scramble. Fear of missing out was on display. The S&P is only 70 points away from new all-time highs. Happy days are here again.

At least until we see how things trade on Monday.

One could argue that the worry and the selloff came out of nowhere so they *should* disappear randomly and without cause too. Maybe that just happened? Of course, one could also argue that the market sniffed out some smoke and was rightly worried about fire. We don’t see it today, so we partied, but it may be obvious in short order.

It feels like we just went through a large risk-off, risk-on cycle. Most everything went down and then up together. The capital flows this week were consistently large. Lots of capital sloshed away from risk and then back towards it. We don’t have good answers as to why either.

Perhaps some leverage was just forced out of the system? If that’s all it is, the bull will keep running. For assets that almost recovered all their losses this week, it’s probably a good sign that *those* assets are in a good place. For assets that simply bounced hard today, but are still far below their prior highs, like Bitcoin, today’s rally is not a sign that those assets are in a good place.

I wouldn’t assume that today is the bottom in those battered assets. If I were looking to put capital into risk, I’d prefer the assets that weren’t very far off their recent highs.

Have a great weekend, see you Monday.

-Mike

Visdom Market Commentary

IMPORTANT INFORMATION

This is general educational information and market commentary and is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction.

All market and economic data herein is as of the date hereof and sourced from Bloomberg unless otherwise stated. The information is subject to change without notice and we have no obligation to update you.

This general market commentary is intended for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The views and opinions expressed constitute the author(s) judgment based on current market conditions, are subject to change without notice, and may differ from those expressed by other employees of Visdom Investment Group LLC ("Visdom") and Visdom. Past performance and any forward-looking statements are not guarantees of future results. It is not possible to invest directly in an index.

We believe the information contained in this material to be reliable and have sought to take reasonable care in its preparation; however, we do not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. Any securities referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by Visdom or by the author(s) in this context. The information presented is not intended to be making value judgments on the preferred outcome of any government decision. This information does not constitute Visdom research, nor should it be considered a recommendation of a particular investment strategy or an offer or solicitation for the purchase or sale of any financial instrument. Investing involves market risk, including the possible loss of principal. You should speak to your financial advisor before making any investment decisions. Visdom and its affiliates do not provide legal, tax or account advice so you should seek professional guidance if you have questions.